|

|

|

|

|

|

|

Current Release of NewViews

For optimal performance, make sure you are running the most current version:

NV 2.34.4 (Aug 13, 2020)

For details, click here.

|

|

Has Your Contact Info Changed?

Let us know about any changes to your contact info by sending email to

info@qwpage.com

or calling Customer Service at 1-800-267-7243.

Don't forget to add the email addresses updates@qwpage.com and office@qwpage.com to your safe sender list!

|

|

|

|

|

|

|

|

|

Don't want to receive these emails anymore? Unsubscribe.

|

|

|

October/November 2020

|

|

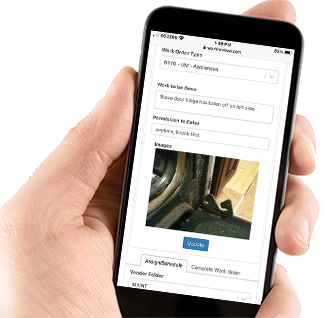

New! Interactive Work Orders Web App Demo

We are excited to announce that you can now access an interactive demo of the NewViews Work Orders Web App through our website.

This demo enables users to experiment with adding new work orders, as well as viewing and modifying outstanding and completed work orders.

The web app, which is very intuitive and easy to use, can be accessed using any PC or mobile device (i.e. tablet or smartphone).

The Work Orders Web App is fully integrated with any NewViews set of books hosted by QW Page that is set up for maintenance and

work order management. To explore the back end integration in the sample set of books used by the web app, contact us to arrange a deep-dive demo.

If you are currently using NewViews as a non-profit or for profit housing provider, but are not taking advantage

of its maintenance and work order management capabilities, you can also contact us for details on incorporating that functionality.

To access the Work Orders Web App demo, click here.

To find out more about our Data Hosting Service, click here.

|

|

Tracking Covid-19 Related Benefits in Your Books

The Covid-19 pandemic has resulted in government emergency benefits in both Canada (e.g. Canada Emergency Wage Subsidy and Temporary Wage Subsidy)

and the United States (e.g. Employee Retention Credit and Paycheck Protection Program). If your organization has taken advantage of these benefits, you should consider

adding one or more tracking accounts to your NewViews books to ensure your bookkeeping records and financial reporting are accurate.

In this article we provide some general insight as to what type of accounts can be added to your books. Of course, each organization is unique and you

should always consult your accountant for guidance. We also encourage you to check the CRA and IRS websites for details on reporting

requirements related to Covid-19 benefits. Below are some useful links to get you started:

Recording Covid-19 related benefits in unique accounts provides you with a simple way to track funds that were received from/not remitted to the government.

If you require assistance with adjusting your books, our Tech Support team can assist you with anything from adding new accounts to

restructuring reports for more detailed analysis.

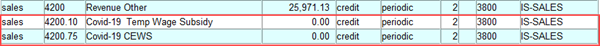

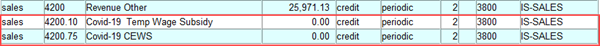

For tracking wage subsidies in Canada, consider adding one or more revenue (SALES) accounts to your NewViews books (as these benefits are considered taxable income by the CRA).

If you have a Trial Balance, accounts should be added to both the Trial Balance and the Income Statement, and the accounts added to the Trial Balance should total to

the accounts added to the Income Statement. If you don't have a Trial Balance, accounts can be added to the Income Statement. The names of these accounts can be

anything that corresponds with your account naming conventions, and the descriptions should reflect the benefit received.

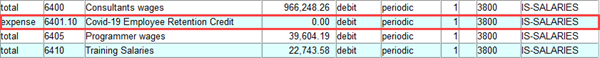

For tracking wage subsidies in the United States, consider adding one or more expense accounts to your NewViews books (as these benefits are considered a deduction

that can be used to reduce wage expenses). If you have a Trial Balance, accounts should be added to both the Trial Balance and the Income Statement, and the

accounts added to the Trial Balance should total to the accounts added to the Income Statement. If you don't have a Trial Balance, accounts can be added to the

Income Statement. The names of these accounts can be anything that corresponds with your account naming conventions, and the descriptions should reflect the benefit

received.

These expense accounts will have debit normal balances, but will show (negative) balances. The negative balances are correct, as the accounts are reducing

the actual wage expenses to the organization. In the end, the negative balances will reduce the total expense amount on the Income Statement

for employee wages.

|

|

Important Reminders

-

You must renew your annual NewViews Update Plan on or before the expiry date to retain your discounted pricing, including volume

discounts (i.e. an annual cost of $215 or less per workstation). To make sure you never miss a renewal date, sign up for automatic

billing by calling Customer Service at 1-800-267-7243.

-

To have a support question answered by email, send your question to support@qwpage.com. Please do not

send support questions to info@qwpage.com, as this will delay any response. Note: You must have a valid support

plan to have your support questions answered by email.

|

|

NewViews NPH and FCHI-2

The Federal Community Housing Initiative - Phase 2 (FCHI-2) is a new rental assistance program for eligible non-profit and co-operative housing

providers with a Section 95 operating agreement that has ended/will end between April 1, 2016 and March 31, 2028. This new

program provides funding for the period from September 1, 2020 to March 31, 2028.

The next release of NewViews for Non-Profit Housing (version 2.34.5) will include changes to the way RGI is tracked and calculated

that will accommodate FCHI-2. All NewViews users will be notified by email when the new version is available for download. Please

note that you must have a valid Update Plan in order to install the update.

|

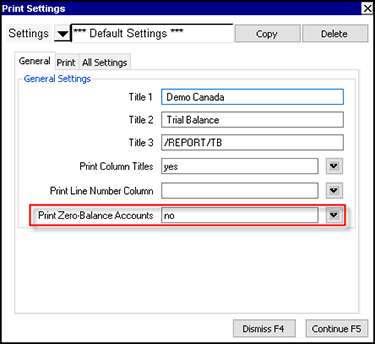

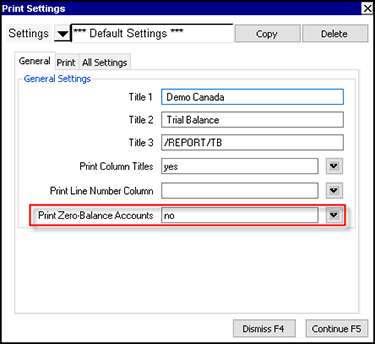

Preventing Zero Balance Accounts from Printing on Reports

If you don’t want accounts with zero balances to print on a report, you can use the Print > All,

Print > Block or Print > Presentation Quality command, depending on which best meets

your needs. In the General tab of the print prompt, simply specify no in the

Print Zero-Balance Accounts field.

Note: With the Print > All and Print > Block commands, any row that has a non-zero numeric column

is always printed. With the Print > Presentation Quality command, rows in the report that are singled out (i.e. not part of a group) are always printed,

even when the account balance is zero. This is based on the assumption that if a row is important enough to appear on its own,

it should also appear on any printed output.

Setting a Preferred View for Reports

Changing the view of one report automatically changes the view that appears when you look at another report. For example, if you change the

view of an Income Statement to Multiple Period Analysis and then navigate to the Balance Sheet, the Multiple Period Analysis

view of the Balance Sheet will be displayed.

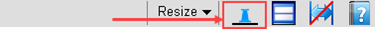

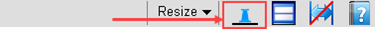

Many users have preferred views for each report, and that specific views can be set as a default for any given report using the Pin Default View

button at the right hand side of the toolbar.

All you have to do is navigate to a report, switch to the view you want to set as a default, then click the Pin Default View button.

You can still switch that report to any other view, but your preferred view set will be the first one you see when you navigate to that particular report.

Note: The Pin Default View button can also be used to set a preferred view for accounts, journals and transactions.

|

|