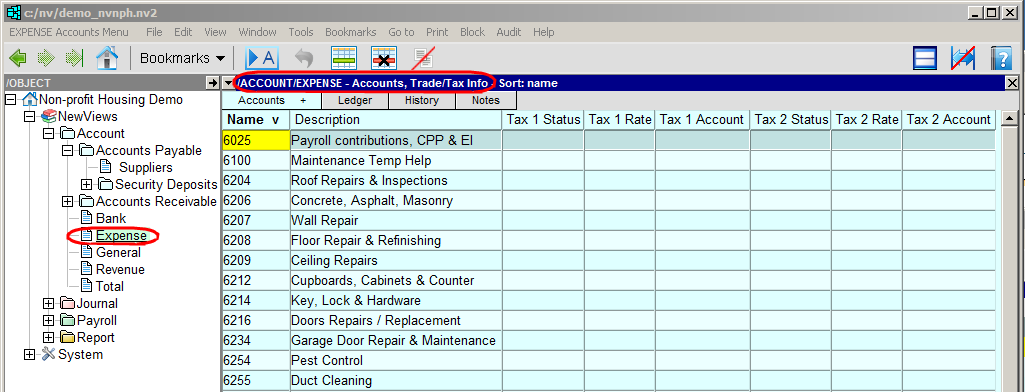

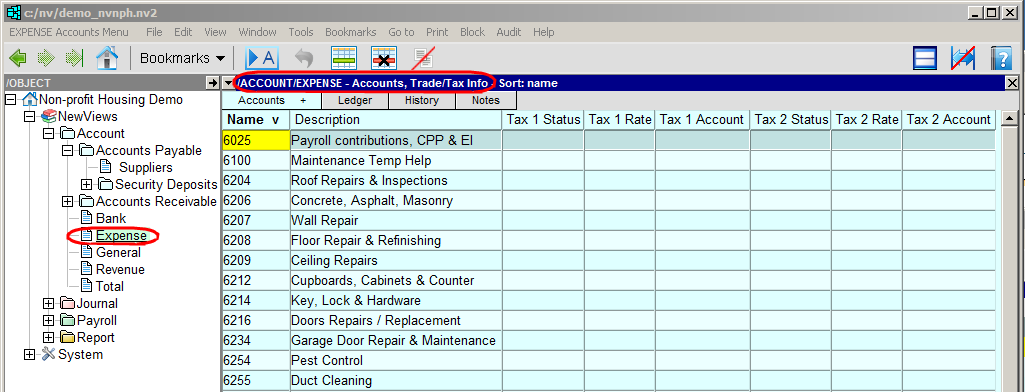

Default tax settings that have been entered for the Purchase Journal can be overridden for specific types of purchases on the Trade/Tax Info view of expense accounts.

| Expense Account Tax Info | |

| Field | Description |

| Tax1/Tax2 Status | taxable - tax on purchases is charged. exempt - tax on purchases is not charged. empty - the default setting in the Purchase Journal is used. The purchase journal has a corresponding Tax1/Tax2 Status setting for whether or not tax is charged. The tax setting on an expense account has higher priority than the purchase journal so it provides the ability to override the purchase journal setting on an expense-by-expense basis. |

| Tax1/Tax2 Rate | If this field has a value, tax on purchases will charged at that percentage. If this field is empty, tax on purchases will be charged using the rate specified for the Purchase Journal. |

| Tax1/Tax2 Account | If an account is specified in this field, tax on purchases will be posted to that account. If this field is empty, tax on purchases will be posted to the account specified for the Purchase Journal. |