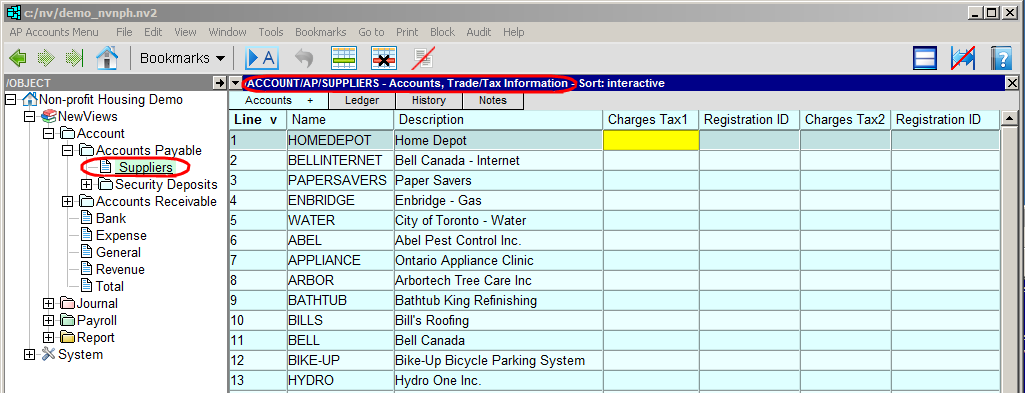

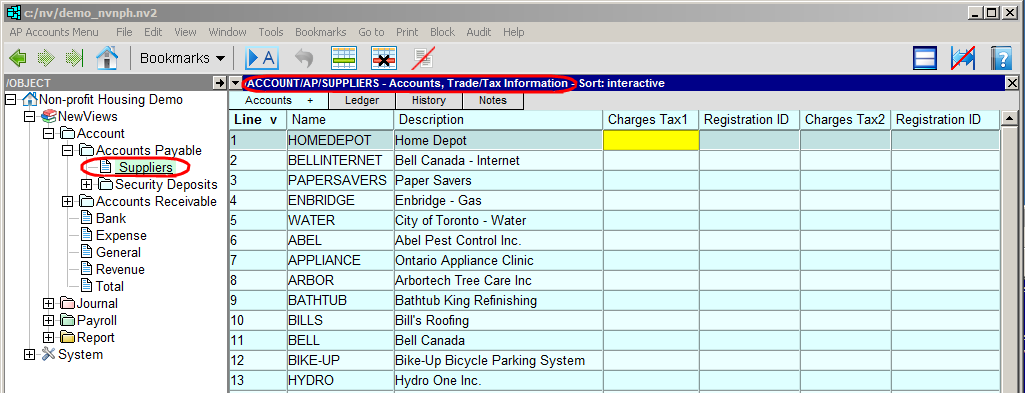

Default tax settings that have been entered for the Purchase Journal can be overridden for specific suppliers on the Trade/Tax Information view of supplier accounts.

| Vendor Trade/Tax Information | |

| Field | Description |

| Charges Tax1/Tax2 | yes - tax on purchases is charged. no - tax on purchases is not charged. empty - the default setting in the Purchase Journal is used. The Purchase Journal has a corresponding Tax1/Tax2 Charged setting for whether or not each tax is charged. The tax setting on a vendor account has higher priority than the purchase journal so it provides the ability to override the purchase journal setting on a vendor-by-vendor basis. |

| Registration ID | The vendor's tax registration number for Tax1/Tax2. |