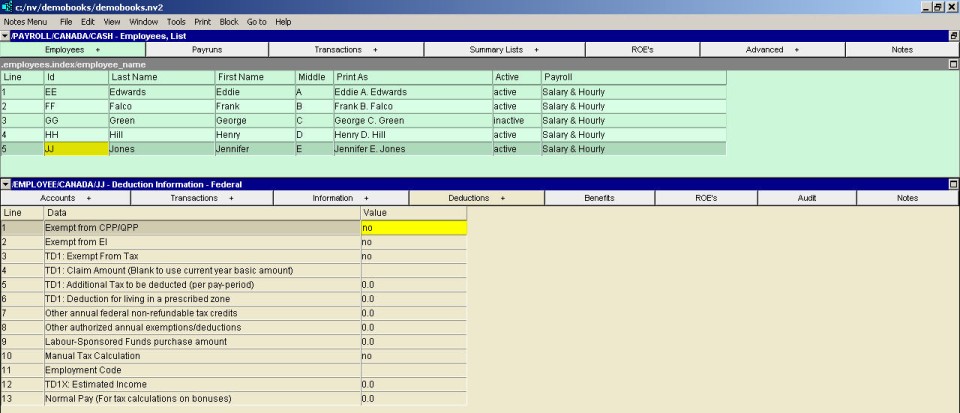

Employee - Federal Deduction Information Window

|

Line

| Field

| Value

|

1

| Exempt from CPP/QPP

| This field specifies whether the employee is exempt from CPP.

|

2

| Exempt from EI

| This field specifies whether the employee is exempt from EI.

|

3

| TD1: Exempt from Tax

| This field (from the TD1 form) specifies whether the employee is exempt from federal tax.

|

4

| TD1: Claim Amount (blank to use current year basic amount)

| This field specifies the claim amount from the employee's federal TD1 form. Only enter an amount if it is different from the current year's basic amount.

|

5

| TD1: Additional tax to be deducted (per pay period)

| If additional federal tax (flat amount) is to be deducted each pay period, the amount is entered in this field. This deducts the amount of tax plus the extra amount.

|

6

| TD1: Deduction for living in a prescribed zone

| The allowable amount that can be deducted for living in a prescribed zone.

|

7

| Other annual federal non-refundable tax credits

| The total amount of any federal non-refundable tax credits is entered in this field.

|

8

| Other authorized annual exemptions/deductions

| The total amount of any other annual exemptions or deductions is entered in this field.

|

9

| Labour-sponsored funds purchase amount

| The annual amount of the employee's labour-sponsored funds purchase is entered in this field.

|

10

| Manual tax calculation

| If the tax deduction is to be entered manually for every paycheck, enter yes in this field.

|

11

| Employment Code

| Enter the appropriate code in this box, Press <F3> to select from a list of valid codes.

|

12

| TD1X: Estimated income

| For employees on commission, their estimated income from the TD1X form is entered in this field.

|

13

| Normal pay (for tax calculations on bonuses)

| Normal pay is used to calculate tax on bonuses when there is no regular pay. The average gross pay amount per pay period is entered in this field.

|