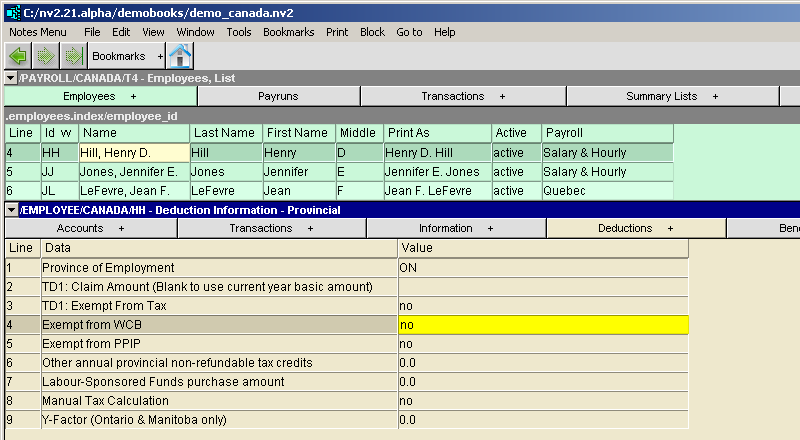

Employee - Provincial Deduction Information Window

|

Line

| Field

| Value

|

1

| Province of employment

| The employee's province of employment (2 letter code) (press <F3> to select.)

|

2

| TD1: Claim amount (blank to use current year basic amount)

| This field specifies the claim amount from the employee's provincial TD1 form. Only enter an amount if it is different from the current year's basic amount.

|

3

| TD1: Exempt from tax

| This field (from the TD1 form) specifies whether the employee is exempt from provincial tax.

|

4

| Exempt from WCB

| This field specifies whether the employee is exempt from the Workers' Compensation Board employer payroll tax.

|

5

| Exempt from PPIP

| This field specifies whether the employee is exempt from the Provincial Parental Insurance Program (PPIP).

|

6

| Other annual provincial non-refundable tax credits

| The total amount of any provincial non-refundable tax credits is entered in this field.

|

7

| Labour-sponsored funds purchase amount

| The annual amount of labour-sponsored funds is entered in this field.

|

8

| Manual tax calculation

| If the tax deduction is to be entered manually for every paycheck, enter yes is in this field.

|

9

| Y-Factor (Ontario, Manitoba, Saskatchewan and British Columbia only)

| The number of dependents used to calculate the Y factor for an employee, if applicable, in Ontario, Manitoba, Saskatchewan or British Columbia.

|