Activate the Payroll you wish to create the Payrun for.

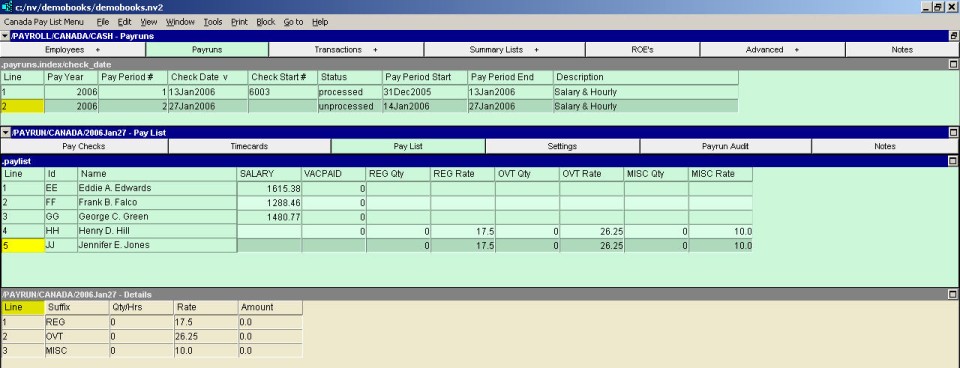

In the payroll window use the window tabs to choose the Payruns window.

In the table of Payruns, issue the command Edit>Append to add a new payrun item.

In the new Payrun line, enter/edit the Payrun year, pay-period number, check date, and starting check number

as appropriate. Please note that the check date determines the Tax Table Year that is used when calculating

deductions.

The pay period # controls the pay period start and pay period end dates.

Note: when creating a separate payrun, e.g. bonus, commission, equity, vacation, etc.

with the same check date, please confirm that the pay period # is the same as the regular payrun.

In the bottom window use the window tabs to choose the Paylist window.

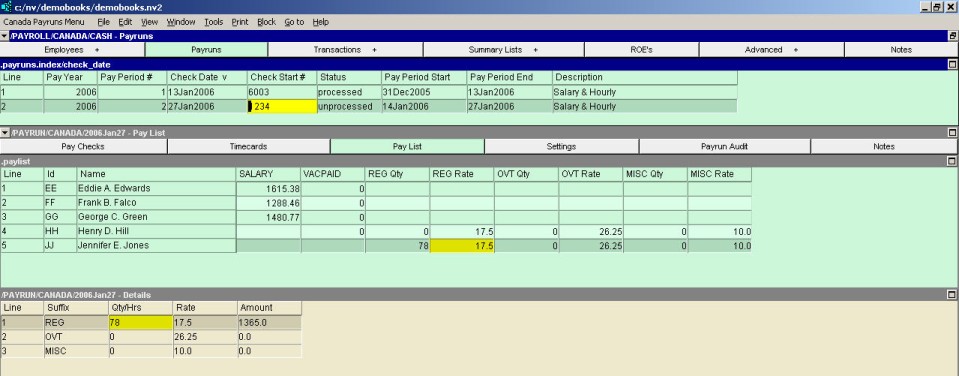

Make changes to the pay list table as required (e.g. fill in the hours for hourly paid employees; adjust amounts for salaried employees, etc. Note: You cannot edit quantities (hours) and accounts if those quantities and amounts are part of a timecard. In this case you may edit the employee timecards, or import hours from an external spreadsheet.

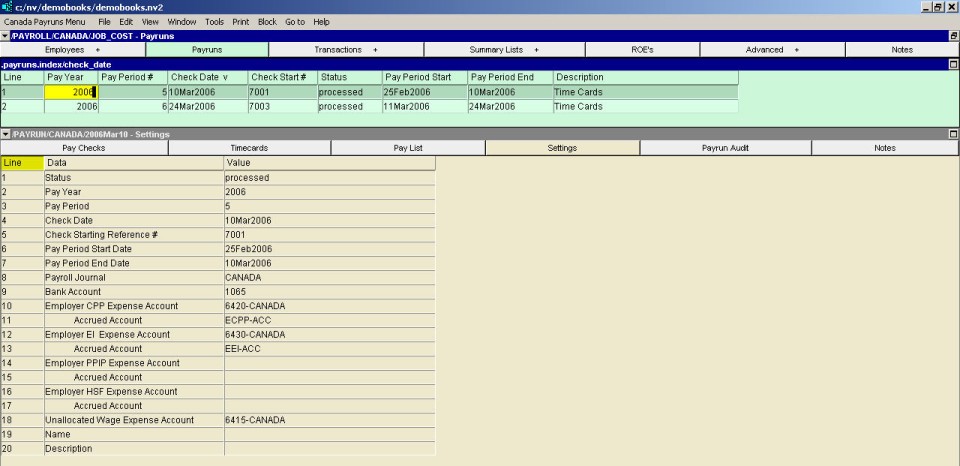

In the bottom window use the window tabs to choose the Settings window. Edit the employer expense and accrued accounts as required. You need only do this for the first payrun. Subsequent payruns will copy these settings.

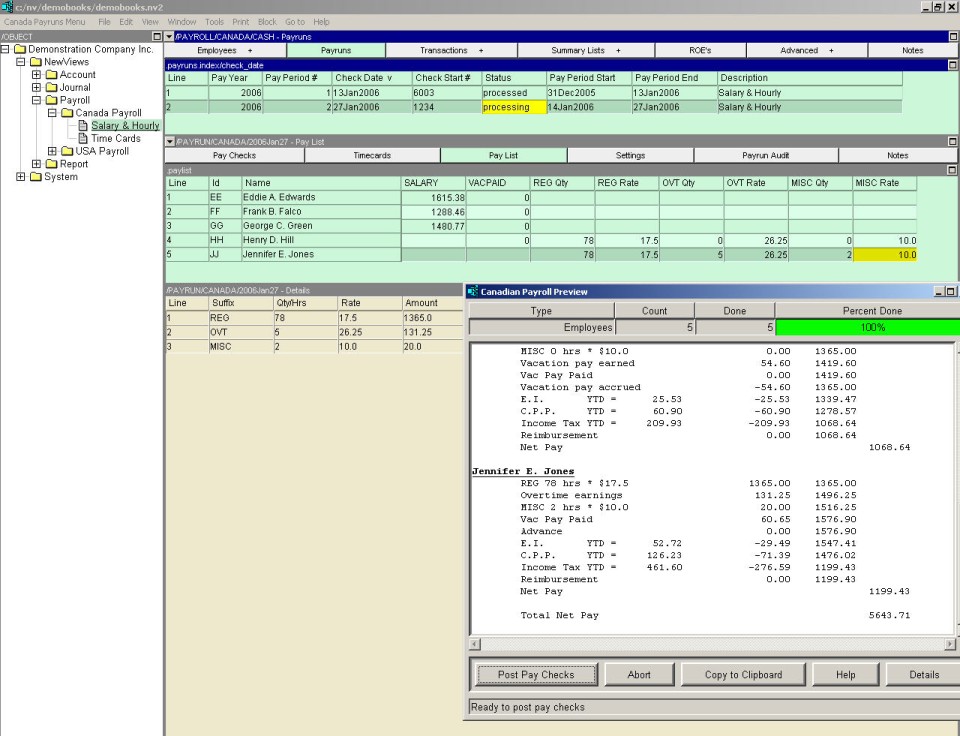

Click on the top Payruns pane.

To process the payrun, change the status field from unprocessed to processed (press <F3> to select). A payroll preview window is displayed to allow you to verify the paychecks that will be posted.

To post the paychecks, click the Post Paychecks button. Alternatively, if you notice mistakes and wish to make changes to the Paylist, click Abort to return to the Paylist where you can make corrections and then reprocess the payrun.