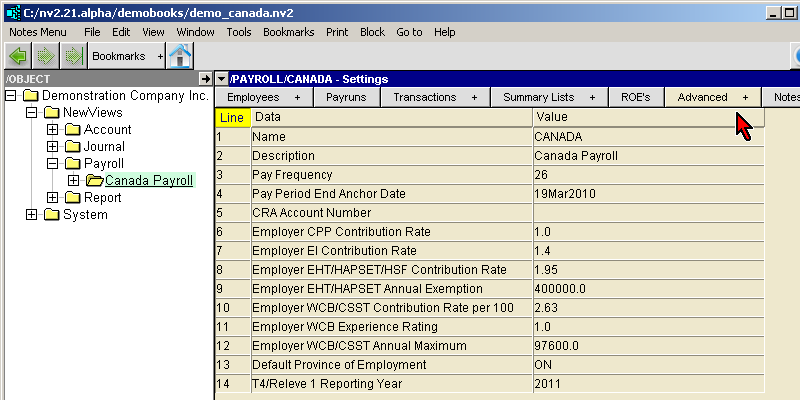

Payroll Settings - Canada

|

Line

| Field

| Value

|

1

| Name

| The name of the payroll folder.

|

2

| Description

| The description of the payroll folder.

|

3

| Pay Frequency

| The number of times an employee is paid in a year. The pay frequency is set to one of: 1 (annual), 4 (quarterly), 12 (monthly), 13 (every 4th week), 24 (semi-monthly), 26/27 (bi-weekly) or 52/53 (weekly).

|

4

| Pay Period End Anchor Date

| The pay period end anchor date for the payroll.

|

5

| CRA Account Number

| The account number you use to remit deductions and contributions to the Canada Revenue Agency.

|

6

| Employer CPP Contribution Rate

| This specifies the contribution rate at which the employer CPP contribution is calculated. For most employers the rate is 1 (1 times the employee deduction). If you do not want payroll to calculate the CPP contribution on each paycheck (you will do it manually) set this field to "0".

|

7

| Employer EI Contribution Rate

| This specifies the contribution rate at which the employer EI contribution is calculated. For most employers the rate is 1.4 (1.4 times the employee deduction), but can vary. If you do not want payroll to calculate the EI contribution on each paycheck (you will do it manually) set this field to "0".

|

8

| Employer EHT/HAPSET/HSF Contribution Rate

| This specifies the contribution rate at which the employer EHT/HAPSET/HSF contribution is calculated. This rate will vary depending on your gross payroll. If you do not want payroll to calculate the EHT/HAPSET/HSF contribution on each paycheck (you will do it manually) set this field to "0".

|

9

| Employer EHT/HAPSET Annual Exemption

| Employers in Manitoba, Newfoundland, Ontario and Quebec with payrolls may be subject to a provincial health care levy. Some jurisdictions legislate an annual payroll exemption before the tax applies.

|

10

| Employer WCB/CSST Contribution Rate per 100

| This specifies the contribution rate at which the employer WCB/CSST contribution is calculated. This rate will vary depending on your industry and injury history.

|

11

| Employer WCB Experience Rating

| Experience rating is used in Alberta and Saskatchewan to adjust premium rates based on the individual employer's accident experience. The default setting is "1.0".

|

12

| Employer WCB/CSST Annual Maximum

| This specifies the annual maximum Insurable Earnings ceiling. This rate will vary by province and year. If you do not want payroll to calculate the WCB/CSST contribution on each paycheck (you will do it manually) set this field to "0".

|

13

| Default Province of Employment

| The province of employment new employees are automatically set to.

|

14

| T4/Releve 1 Reporting Year

| The year used on the T4 List and Releve 1 List windows.

|