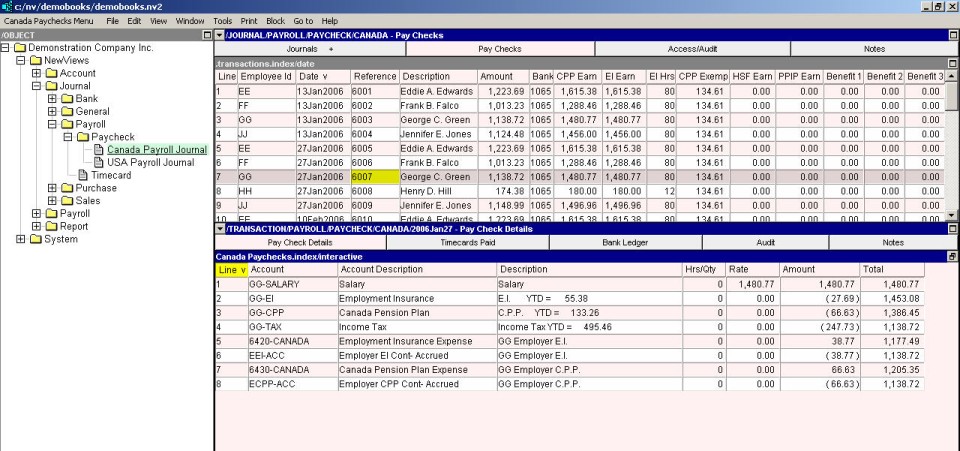

NV2 provides two payroll journals: a Canada Payroll journal and a USA Payroll journal. NV2 Payroll uses these journals and entries cannot be added to them directly. You can use the Payroll journal to view a listing of all payroll checks to all employees.

Payroll transactions, which are recorded in a payroll journal, typically involve a series of debit and credit entries that debit payroll expense accounts (e.g. Employee Salaries and Employer Contributions) and credit employee and government liability accounts (e.g. Employee Salaries Payable and Employee Deductions Payable).

When a payroll check is actually issued to an employee, another transaction is needed to debit Employee Salaries Payable account and credit the Cash in Bank account. This last transaction could be recorded in the payroll journal or the bank account.

NV2 automates the process of entering transactions in the payroll journal. It also records the detailed breakdown of employee deductions and employer contributions in distributions.

NOTE: The Payroll Journal can only be used to view transactions that were previously made in the Payroll system; you cannot add transactions directly to this journal.