Adding a purchase made with petty cash involves debiting one or more expense/asset accounts and any applicable tax accounts, and crediting the petty cash account. With NV2, you don't have to be concerned with debits or credits when entering a petty cash purchase. You simply specify the petty cash account you are using, and the details of the items you are purchasing. Trade taxes, if applicable, are calculated and added automatically.

Purchases made with petty cash can be added to the Purchase Invoices Journal, or they can be added directly to the petty cash account. When you add a purchase to the Purchase Invoices Journal, postings are made automatically to the petty cash account, to the expense/asset accounts that correspond to the items purchased, and to any applicable tax accounts. When you add a purchase directly to the petty cash account, postings are made automatically to the corresponding expense/asset and tax accounts, and a journal entry is created in the Purchases Invoices Journal.

The choice of entering petty cash purchases in a journal or in the petty cash account is completely up to you; the end result is identical either way.

Important! In order for trade taxes on petty cash purchases to be calculated correctly, you must first set up the default trade taxes for purchases (see Trade Tax Settings for Purchases Journals for more information). However, you can always edit tax amounts on purchases (e.g. special circumstances for a particular purchase that affect the tax calculation).

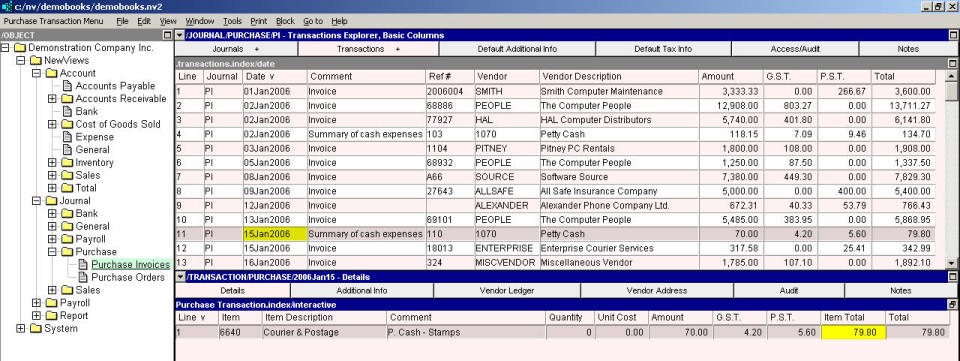

To add a purchase to the Purchase Invoices journal:

Click the Purchase Invoices Journal (NewViews/Journal/Purchase/Purchase Invoices) in the NV2 Database Explorer.

If the right window is not the Transactions Explorer window, click the window list button at the left of the title bar that reads /JOURNAL/PURCHASE/PI and choose Transactions Explorer).

Press <Alt+E+A> or issue the command Edit>Append to add a new purchase. (NOTE: The line number is generated automatically.)

Enter the purchase date by typing the date or press <F3> to select the date.

Type the comment (usually the vendor name) and reference number, in the Comment and Ref # fields, respectively.

In the Vendor field, enter the petty cash account name (type the account name or press <F3> to select). The petty cash account description is filled in automatically.

Do not enter anything in the Net, GST, PST or Total fields, since they are generated automatically.

Activate the transaction detail table by pressing <F6>.

Press <Alt+E+A> to add a purchase item.

Enter the account name for the item (type the account name or press <F3> to select), the item description will be filled in automatically.

In the Comment field enter and necessary comments. You can use any combination of letters, numbers, spaces or special characters and can be as long as you want.

If you are tracking quantities for the item, fill in the quantity and rate (if it does not appear automatically) and the amount will be calculated automatically.

If you are not tracking quantities, fill in the net amount for the item. Taxes and item total amount are calculated automatically.

Repeat steps 9 - 12 for each purchase item.

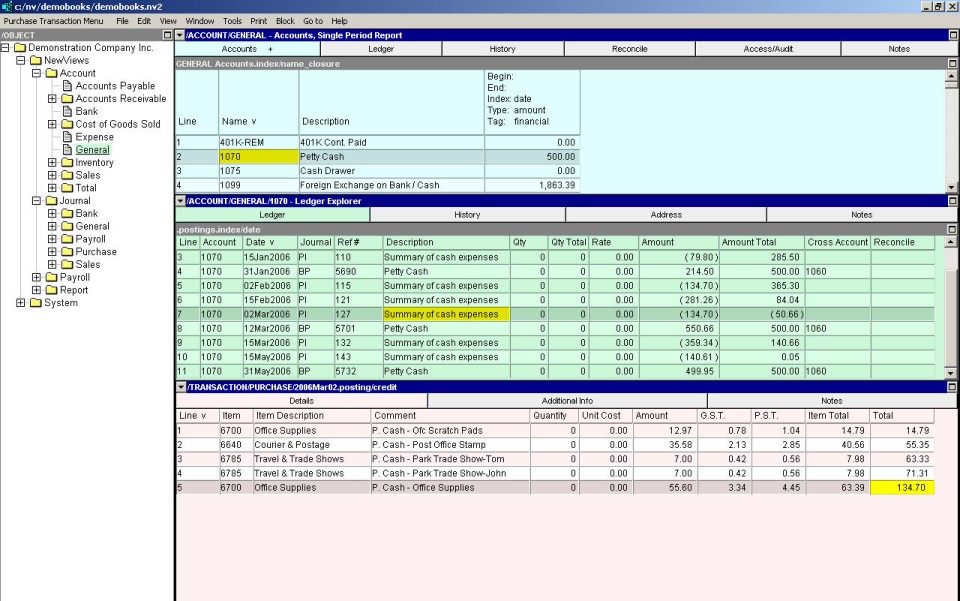

To add a purchase to the petty cash account:

Click general ledger accounts (NewViews/Account/General) in the NV2 Database Explorer.

Activate the petty cash account to which the purchase is to be added, and then press <F6> or click anywhere in the petty cash account ledger (middle pane).

Press <Alt+E+A> or issue the command Edit>Append to add a new item to the ledger. (NOTE: The line number is generated automatically.)

If the Purchase Invoices journal (PI) is not specified in the Journal field, activate the Journal field and press <F3> to select the Purchase Invoices journal (press <Enter> or double click to select the journal name).

NOTE: You can preset the Journal field using the Edit>Default Value>Set command.

Enter the purchase date by typing it in or press <F3> to select the date.

Type in the reference and description (usually the vendor name), in the Reference and Description fields, respectively.

Do not enter the amount, since it is generated automatically. Leave the Cross Account field blank as well.

Activate the transaction detail table by pressing <F6>.

Press <Alt+E+A> to add a purchase item.

Enter the account name for the item (type the account name or press <F3> to select), the item description will be filled in automatically.

If you are tracking quantities for the item, fill in the quantity and rate (if it does not appear automatically) and the net amount will be calculated automatically.

If you are not tracking quantities, fill in the net amount for the item. Taxes are calculated automatically, as is the item total amount.

Repeat steps 9 - 11 for each purchase item.

If you want your petty cash purchases to stand out (e.g. in order to quickly identify trends with respect to items being purchased with petty cash), you may want to add a separate journal just for this type of purchase. See Adding Journals for more information.