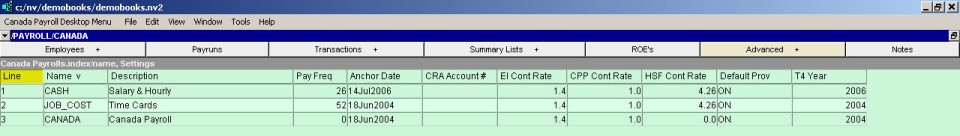

Canadian payrolls are accessed through NewViews/Payroll/Canada Payroll.

To view a list of payrolls:

Click on NewViews/Payroll/Canada Payroll in the NV2 Database Explorer.

In the top window, select "Advanced - Sub Payrolls- Folder Management"

If you did not convert from the DOS version of NewViews (or the DOS books you converted did not have Payroll) there will be one payroll in the list called Employees. You can change the name and/or description of this payroll if you like, and use it to add your employees. To change the description, select "Advanced - Sub Payrolls- Folder Management", then move to the description field and type in the new description.

You can also add additional payrolls to the table if you want to split your employees into separate payrolls (e.g. office and production payrolls, or management and staff payrolls).

To add a new payroll:

Issue the command Edit>Append or Edit>Insert to add a new item to the Payrolls table.

Enter a name and description for the payroll in the Name and Description fields, respectively.

In the Pay Frequency field, enter the number of pay periods in the year (press <F3> to select).

In the Anchor Date field, enter the ending date of one of your pay periods. For example, if the payroll is weekly and the pay periods end on Fridays, the anchor date is any Friday you wish to enter. NV2 uses the anchor date to automatically calculate the begin and end date for each pay period when you process payroll. For more information see Anchor Date.

Fill in your CRA account number. (Required for printing T4s, Records of Employment, and other government forms.)

Fill in the EI Contribution rate with the rate you contribute Employment Insurance premiums at. For most employers, the rate is 1.4 (you contribute 1.4 times the employee's deduction), but under some circumstances the rate may be lower.

NV2 Payroll uses this rate to calculate and record the expense and liability for the employer contribution to EI. If you do not want NV2 Payroll to calculate your EI costs, then leave this entry blank.

Fill in the CPP Contribution rate with the rate you contribute Canada Pension Plan contributions at. For most employers, the rate is 1.

NV2 Payroll uses this rate to calculate and record the expense and liability for the employer contribution to C.P.P. If you do not want NV2 Payroll to calculate your C.P.P. costs, then leave this entry blank.

For employers in Quebec, fill in the HSF Contribution rate with the rate at which you contribute to the Quebec Health Services Fund.

NV2 Payroll uses this rate to calculate and record the expense and liability for the employer contribution to H.S.F. If you do not want NV2 Payroll to calculate your H.S.F. costs, then leave this entry blank.

Fill in Default Province with the province code that applies to all or most of your employees. Press <F3> to choose the province from a pop-up list.

Fill in T4 Year with the current year.

When the new payroll is recorded (by issuing the File>Save command or moving off the line), it will automatically appear in the NV2 Database Explorer under Canada Payroll.