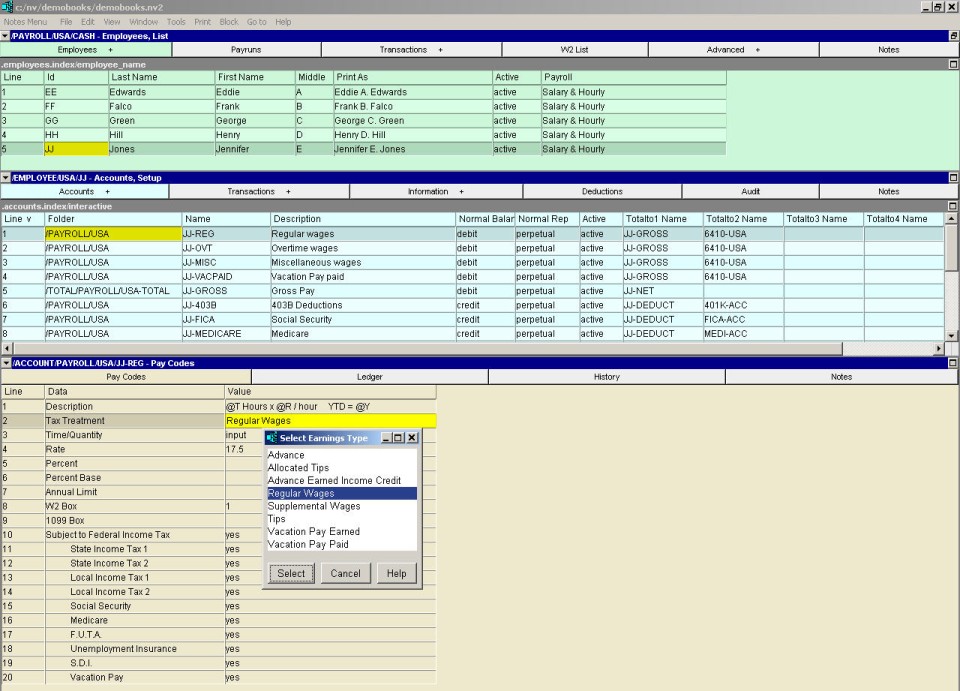

The Pay Codes window settings control the behaviour of the employees earnings account.

This is where you set the pay rate, tax treatment, check description, annual limit, subject to tax, etc.

To edit a block of identical payroll accounts, navigate to the /ACCOUNTS/PAYROLL/CANADA.

On the blue account table, switch to an appropriate Setup - Payroll view.

See Setup - Paycodes below for more.

Pay Codes - Debit / Earnings Accounts

|

Line

| Pay Code

| Values

| Comments

|

1

| Description

| The text used in the description of the posting to the account when paychecks are processed.

Several "codes" can be included in the text that are replaced with amounts when the posting is created. The codes are:

|

@T

@R

@Y

@P

| @T - Replaced with the time/quantity used to calculate the earnings.

@R - Replaced with the rate used to calculate the earnings.

@Y - Replaced with the year-to-date total of the earning.

@P - Replaced with the perpetual total of the earning.

|

2

| Tax Treatment

| This field controls whether and how the earnings are taxed, and for some tax treatment types may determines the amount of the earning. Different types of earnings are taxed in different ways.

|

Advance

Allocated Tips

Advance Earned Income Credit

Regular Wages

Supplemental Wages

Tips

Vacation Pay Earned

Vacation Pay Paid

| Advance - The earnings are an advance to the employee and are not taxed, nor are any other deductions taken on the amount. The amount does not appear on the W2.

Allocated Tips - The earnings are tips that should be reported in box 8 of the W2.

Advance Earned Income Credit - The earning is an advance EIC payment.

Regular Wages - The earnings are to be taxed as regular taxable wages. This type is used for salaries, hourly wages and overtime. This type is also used when vacation pay is paid on each pay check.

Supplemental Wages - Wages that are to be taxed at the current rate for supplemental wages.

Tips - The earnings are tips.

Vacation Pay Earned - This type is used to designate the earnings as vacation pay earned on the current paycheck. The earnings are not taxed, nor do the earnings appear on W2 forms.

Vacation Pay Paid - This type is used to designate the earnings as vacation pay paid to the employee. The earnings are subject to taxes, and do appear on W2 forms.

|

3

| Time/Quantity

| e.g., 40

e.g., input

| This field is used for earnings that are based on time worked or a quantity (e.g. hours worked) multiplied by a rate (e.g. hourly rate). If the time/quantity is constant from one paycheck to the next, enter the number in this field. If the time/quantity changes from one paycheck to the next, enter input. If the earnings are a flat rate (e.g. a salary), leave this field blank.

|

4

| Rate

| e.g., 1200

e.g., 20

| For flat rate earnings amounts such as salary, enter the amount per pay period and leave the Time/Quantity field blank. For variable earnings such as hourly wages, enter the rate of pay per hour, and enter input in the Time/Quantity field.

A note regarding vacation pay paid: When used on the vacation pay paid account, the amount specified is added to the employee's check. Since the payment of vacation pay occurs infrequently, processing the PAYRUN automatically resets the rate to zero.

To pay out all of an employee's accrued vacation pay (including any amounts payable for the current pay period), set the Rate to "ALL".

|

5

| Percent

| e.g., 4

| To base the earnings on a percentage of the employee's wages, enter the percentage rate in this field and leave the Time/Quantity and Rate fields blank.

|

6

| Percent Base

| If this field is left blank, the percentage calculation is based on the employee's taxable income.

Alternatively, an "expression" may be entered to base the percentage on selected earnings and/or deductions. The expression is composed of employee accounts suffixes (such as "REG", "TAX", etc.) combined with the arithmetic symbols "+", "-", "*" (multiplication) and "/" (division).

For example, REG+OVT+COM-TAX would mean the percentage is based on the amounts posted to the accounts with the suffixes REG, OVT, and COM, minus the amount posted to the account with the suffix TAX.

NOTE: The suffixes you enter must correspond to suffixes found in the employee's accounts. The suffixes of total account cannot be used in the expression.

NOTE: The suffix Net may be used to base the percentage on the net amount of the paycheck at the point the percentage is encountered when processing the employee's accounts.

|

7

| Annual Limit

| e.g., 50000

| This field is used as a safety catch to prevent the earnings from exceeding a set annual amount. This field has no effect if left blank or if it contains 0.00.

|

8

| W2 Box

| This field specifies where the amount should appear on the W2 form.

|

9

| 1099 Box

| This field specifies where the amount should appear on the 1099 form.

|

10 to 20

| Subject to Federal, State and/or Local Income Tax, Social Security, Medicare, F.U.T.A., Unemployment Insurance, SDI, Vacation Pay

| These fields allow you to control whether the earnings are taxable, insurable, etc. NOTE: You control whether the earnings are subject to the various deductions - NewViews payroll does not impose any rules on this. Questions about whether or not a given type of earnings is subject to deductions must be addressed to the IRS or your state tax office.

|

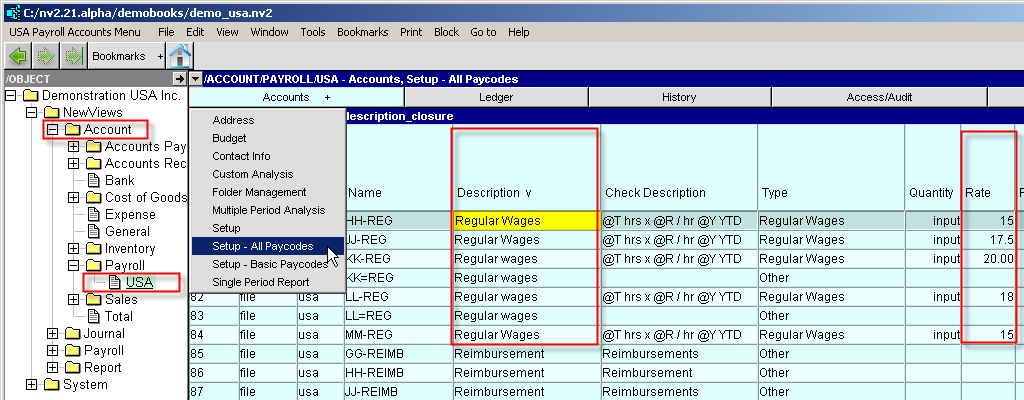

When checking or editing multiple employees, it may be useful to sort all payroll accounts by description.

When sorted by description, all accounts of the same type should be in order.

Set a block on the appropriate employees to quickly and easily update the required fields.

You may use the Fill Column tool to make changes.