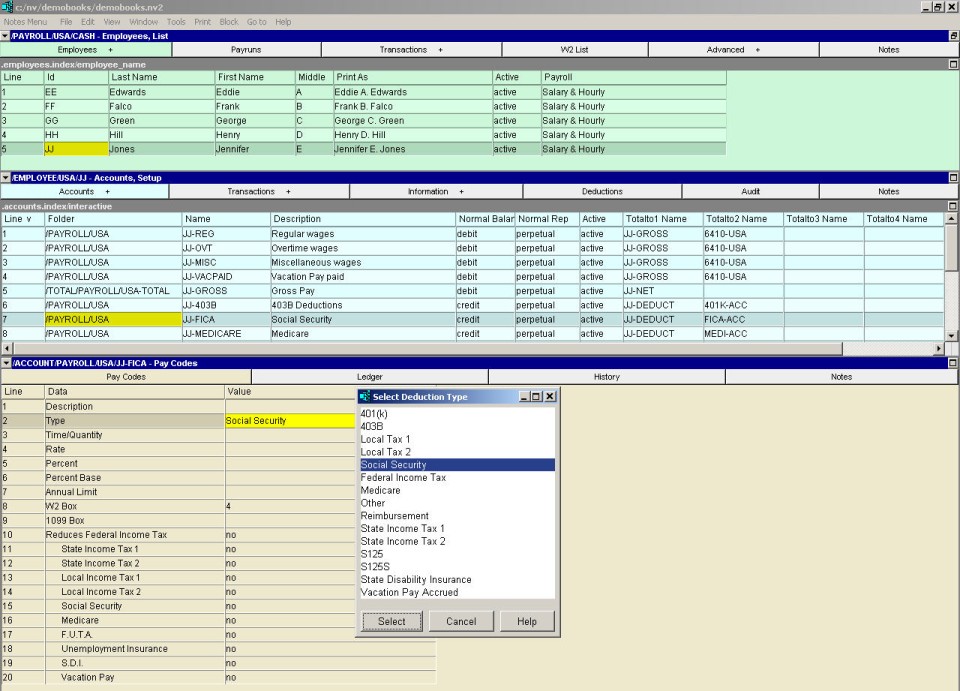

The Pay Codes for deduction (credit normal balance) accounts are:

| Pay Codes - Credit / Deduction Accounts | |||

| Line | Pay Code | Values | Comments |

| 1 | Description | The text used in the description of the posting to the account when paychecks are processed. Several "codes" can be included in the text that are replaced with amounts when the posting is created. The codes are: | |

| @T @R @Y @P | @T - Replaced with the time/quantity used to calculate deduction. @R - Replaced with the rate used to calculate the deduction. @Y - Replaced with the year-to-date total of the deduction. @P - Replaced with the perpetual total of the deduction. | ||

| 2 | Type | This field controls what type of deduction the account is used for. The deduction types are: | |

| 401(k) 403(b) Local Tax 1 Local Tax 2 Social Security Federal Income Tax Medicare Other Reimbursement State Income Tax 1 State Income Tax 2 S125 S125S State Disability Insurance Vacation Pay Accrued | 401(k) - The deduction is for a 401(k) retirement plan. 403(b) - The deduction is for a 403(b) retirement plan. Local Tax 1 - This deduction is a local tax. Local Tax 2 - This deduction is a local tax. Social Security - The deduction is Social Security. Federal Income Tax - This deduction is a federal tax. Medicare - The deduction is the Medicare portion of FICA. Other - A user-defined deduction controlled by the Time/Quantity, Rate, and Percent settings. Reimbursement - The account is used to manage reimbursements owed to the employee. When a paycheck is processed, an amount equal to the balance of the account is added to the employee's check, thus reducing the reimbursement payable to 0.00. This deduction has no effect on tax calculations, nor do the amounts appear on a W2 form. State Income Tax 1 - The deduction is state income tax. State Income Tax 2 - The deduction is state income tax. S125 - The deduction is for a Section 125 retirement plan. S125S - The deduction is for a section 125 S (Corporate) (S125S) cafeteria plan. State Disability Insurance - The deduction is state disability insurance. Vacation Pay Accrued - This type is used to designate the deduction as vacation pay withheld (to be paid out at a later date.) The deduction does not reduce taxes. | ||

| 3 | Time/Quantity | e.g., 10 e.g., input | This field is used for deductions that are based on time worked or a quantity (e.g. hours worked) multiplied by a rate (e.g. hourly rate). If the time/quantity is constant from one paycheck to the next, enter the number in this field. If the time/quantity changes from one paycheck to the next, enter input. If the deductions are a flat rate (e.g. a tool expense), leave this field blank. |

| 4 | Rate | e.g., 25 | For flat rate deductions amounts, enter the amount per pay period and leave the Time/Quantity field blank. For variable deductions, enter the rate of deduction per hour, and enter input in the Time/Quantity field. |

| 5 | Percent | e.g., 4 | To base the deductions on a percentage of the employee's wages, enter the percentage rate in this field and leave the Time/Quantity and Rate fields blank. |

| 6 | Percent Base | If this field is left blank, the percentage calculation is based on the employee's taxable income. Alternatively, an "expression" may be entered to base the percentage on selected earnings and/or deductions. The expression is composed of employee accounts suffixes (such as "REG", "TAX", etc.) combined with the arithmetic symbols "+", "-", "*" (multiplication) and "/" (division). For example, REG+OVT+COM-TAX would mean the percentage is based on the amounts posted to the accounts with the suffixes REG, OVT, and COM, minus the amount posted to the account with the suffix TAX. NOTE: The suffixes you enter must correspond to suffixes found in the employee's accounts. The suffixes of total account cannot be used in the expression. NOTE: The suffix Net may be used to base the percentage on the net amount of the paycheck at the point the percentage is encountered when processing the employee's accounts. | |

| 7 | Annual Limit | e.g., 500 | This field is used as a safety catch to prevent the deductions from exceeding a set annual amount. This deduction is based on the gross earnings above, or the Percent Base definition. This field has no effect if left blank or if it contains 0.00. |

| 8 | W2 Box | This field specifies where the amount should appear on the W2 form. | |

| 9 | 1099 Box | This field specifies where the amount should appear on the 1099 form. | |

| 10 to 20 | Reduces Federal , State and/or Local Income Tax, Social Security, Medicare, F.U.T.A., Unemployment Insurance, SDI, Vacation Pay | These fields allow you to control whether the deduction reduces the earnings on which the deductions are based. NOTE: You control whether a deduction reduces other deductions - NewViews payroll does not impose any rules on this. Questions about whether or not a given deduction reduces any of these government deductions should be addressed to the Federal, State, and / or local government taxation agencies. | |

See also Adding a Deduction Account