A common Accounts Receivable task is to charge interest on one or more overdue accounts (i.e. accounts

with open and unpaid items).

-

Position on any table of accounts (blue).

This can be anywhere accounts appear as rows of a (blue) table, including reports.

-

Either position on the account you want to charge interest for or else mark a block of accounts.

If no block is marked then the current account is processed.

If you want to explicitly select a number of accounts to be charged then

use the Block>Start and Block>End commands

to mark the accounts in a block.

Note: total accounts and branch folders will be skipped.

-

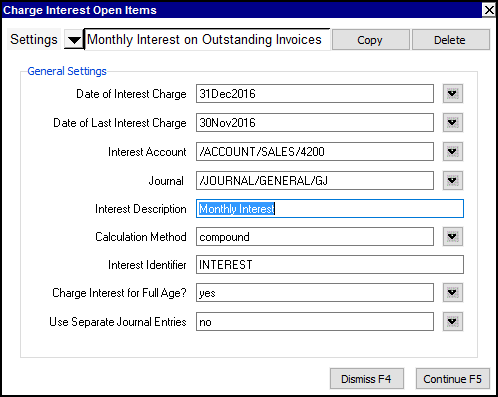

Issue the Tools>Charge Interest>Open Items command.

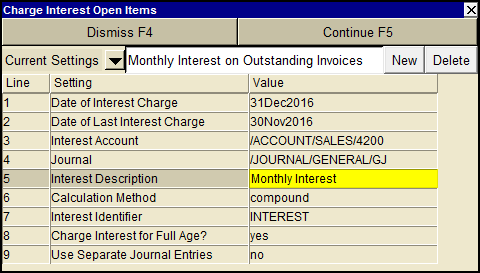

A charge interest open items settings window will appear such as that shown below.

-

Fill in the settings fields.

The meaning of each setting is described later in this section.

-

Click the <Continue> button or press <F5> to charge interest on open items.

When <Continue> is clicked, transactions are created to record the interest.

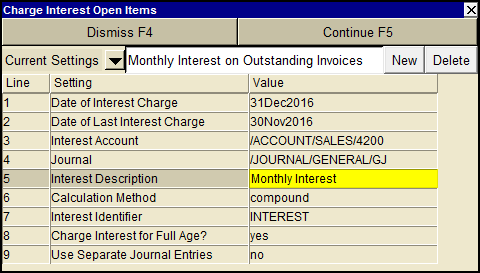

Line

| Field

| Values

| Comments

|

1

| Date of interest charge

|

| Interest transactions created, if any, will have this date.

|

2

| Date of last interest charge

|

| Interest amount calculated will be the incremental addition since this date.

|

3

| Interest account

|

| The name of the account to balance the interest charge transaction (e.g. for Accounts Receivable an Interest revenue such as "Charged on Overdue Accounts").

|

4

| Journal

|

| The journal used for interest charge transactions.

|

5

| Interest description

|

| The description on the customer's ledger interest charge posting.

|

6

| Method (simple, compound)

| simple

compound

| Simple interest will calculate interest only on the original overdue transactions. Compound interest will add to that any interest calculated on previous interest charges.

|

7

| Interest identifier

|

| This is a keyword which is used to identify prior interest charges. If this keyword is found in a transaction's description (case insensitive), then the transaction is known to be a prior interest charge.

|

8

| Charge interest for full age?

| yes

no

| yes will ignore the Trade/Tax Info value for the grace period. See Trade/Tax Settings for Customer Accounts for more.

|

9

| Use separate journal entries

| yes

no

| yes will create a separate transaction for each account.

no will create a single transaction with a distribution detail item for each account.

|

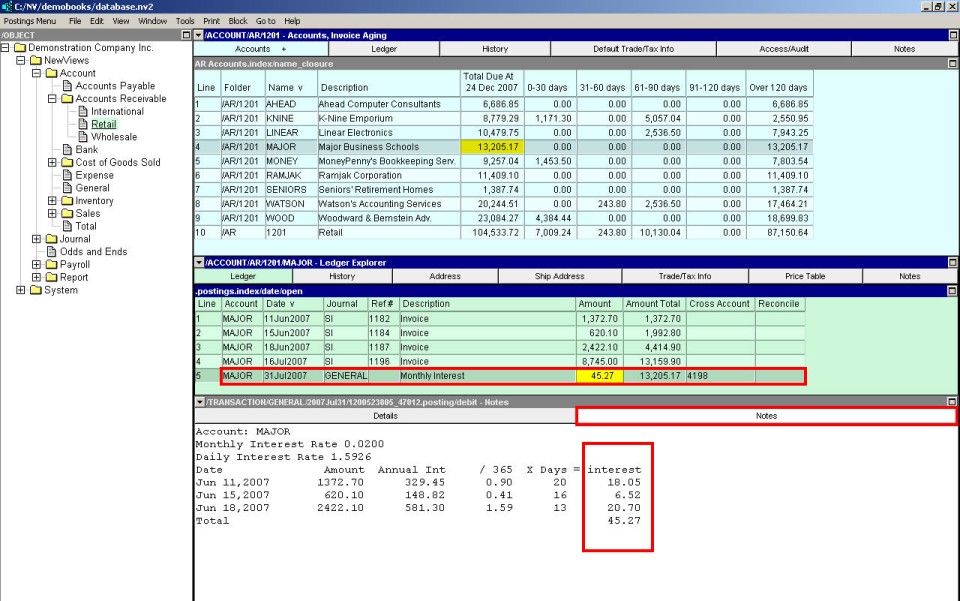

Above is a sample result showing a monthly interest charge.