T4, T4A, T5 and T5018 can be printed to paper or to electronic media (in XML format).

If an employer files 1 to 50 slips (T4, T4A, T5, T5018) and you use a computer system to generate them, Canada Revenue Agency encourages you to file on electronic media.

Note: Starting January 2010, if you submit more than 50 original information returns (slips), you will be required to file electronically using the Internet. This means that if you previously filed returns on paper, DVD, CD, or diskette, you must now file over the Internet.

To assist filers in meeting the new requirements, the Canada Revenue Agency (CRA) will be increasing the file size for its secure Internet file transfer (XML) service from 20 megabytes to 150 megabytes. For T4 returns, filers will be able to send approximately 160,000 slips in an uncompressed file and 1.6 million slips in a compressed file. For T5 returns, filers will be able to send approximately 260,000 slips in an uncompressed file and 2.6 million slips in a compressed file.

For more information on mandatory Internet filing for information returns, go to Internet File Transfer (GIFT) or subscribe to our Electronic Filing for Businesses mailing list at www.canada.ca/mailing-lists

If an employer files 50 to approximately 160,000 various information slips (up to 150 MB), you must file electronically in extensible mark-up language (XML) by Internet File Transfer (XML) or on electronic media.

Files generated that are less than 150 MB, may be filed by Internet file transfer via the Internet.

As of February 2008 the CRA Help desk for Internet File Transfers and XML issues is 1-877-322-7849.

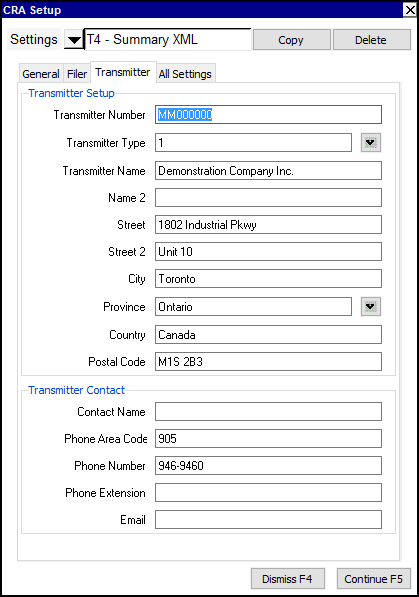

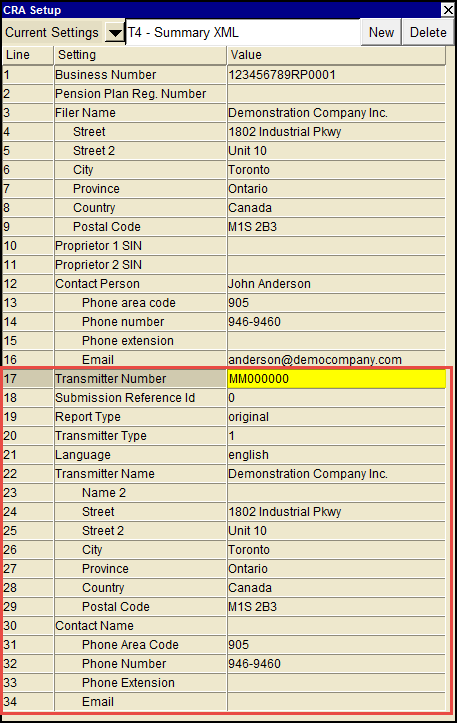

Fill in fields 17 to 32 on the CRA Setup prompt, see the XML file table below for detailed instructions.

| Print T4 Summary - XML file | |||

| Line | Field | Value | |

| 17 | Transmitter Number | If you are filing on your own behalf, you may enter MM000000 | |

| If you are filing on behalf of another organization please contact the Canada Revenue Agency at 1-800-665-5164 to receive a transmitter number. | |||

| 18 | Submission Reference Id | This is a unique number that is created by the transmitter to identify each submission filed. If you are filing on your own behalf, you may enter 0 | |

| 19 | Report Type | original amended | original - Marks the xml file as containing original slips. amended - Marks the xml file as containing amended or cancelled slips. |

| 20 | Transmitter Type | 1 my returns 2 for others 3 software package 4 software vendor | 1 my returns - 1 if you are submitting your returns. 2 for others - 2 if you are submitting returns for others (service providers). 3 software package - 3 if you are submitting your returns using a purchased software package. 4 software vendor - 4 if you are a software vendor. |

| 21 | Language | English French | Language of communication. |

| 22 | Transmitter Name | Name of the transmitter. | |

| 23 | Name 2 | If the name of the transmitter is more than 30 characters, enter the remaining characters on this line. | |

| 24 - 29 | Transmitter's Address | Enter the Transmitter's address. | |

| 30 | Contact Name | Enter the name of the contact person. | |

| 31, 32, 33 | Phone number | Enter the phone number and extension of the contact person. | |

| 34 | Email | Enter the email account of the contact person. | |

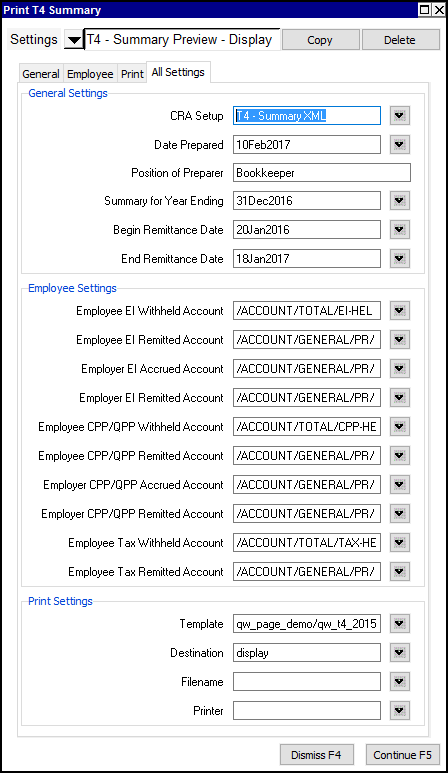

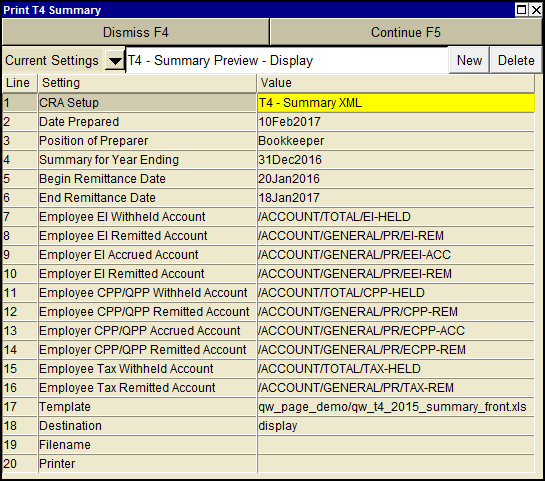

In field 1 of the Print T4 Summary prompt, choose the CRA Setup saved in the above step.

A Web access code (WAC) is a personalized code that the Canada Revenue Agency (CRA) mails to you. You need a WAC with other identifiers such as a Business Number or account number, to access the secure areas of the CRA's Internet filing Web pages.

Where do you find your Web access code?

It appears above the Business Number on your personalized T4 Summary or on the Web Access Code for Electronic Filing letter that we sent you. The personalized summary and letter also shows your account number.

Note: You cannot use last year's Web access code, as it is only valid for one tax year.

If you do not have a Web access code, call the CRA Help Desk at 1-877-322-7849.

What does a Web access code consist of? A WAC consists of six characters. Two of the characters are letters and four are numbers. The letters can be identified with an asterisk below them. The WAC is case sensitive, which means you must enter it exactly as it appears on your personalized T4 Summary, NR4 Summary, or Web Access Code for Electronic Filing letter. If you do not enter the code correctly, you will not be able to access the secure areas of the Internet filing Web site.

Click here for the Canada Revenue Agency secure Web site