Each NewViews bank account has an EFT Canada Info and a EFT USA Info view. Fill in the EFT USA Info view if you want to use the bank account for electronic funds transfers. The bank may then be used for direct deposits and vendor EFT/ACH payments.

NOTE: USA banks may only transfer electronically to USA employees and vendors. Canadian banks may only transfer electronically to Canadian employees and vendors.

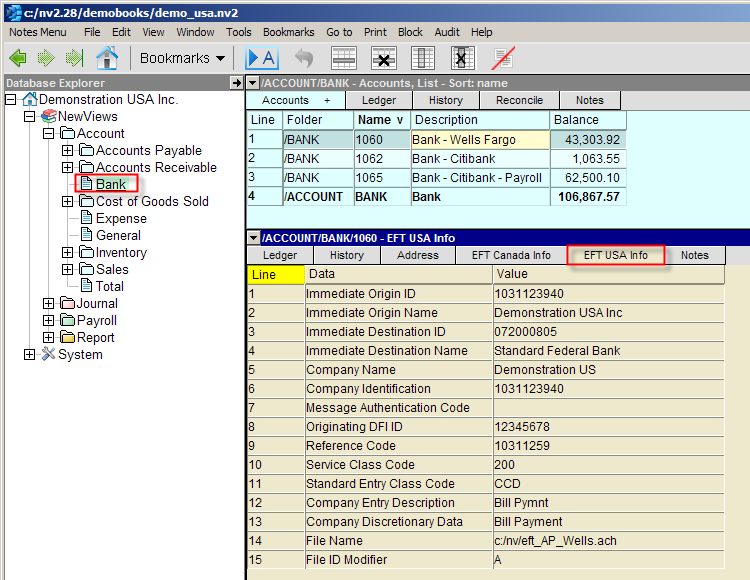

Shown above is the EFT USA Info view of a bank account, containing the settings necessary for electronic payments. Details are provided below on how to fill in EFT information for use with the ACH network.

The company bank account you use as the source of EFT payments can be any banking institution supported by the ACH network.

Contact you company bank directly and ask to enroll in their EFT services. Your bank will provide an application form that will collect the information needed by your bank. The initial setup may take several days. Tell your account manager that your accounting software is capable of generating the EFT/ACH, Direct Deposit and Corporate (Vendor) Payment file. With the account manager and the application form, you should have all the information required to set up and activate EFT/ACH services with your bank.

| Line | NACHA | NewViews | Typical Value |

| 1 | Immediate Origin | Immediate Origin ID | Your 10-digit company number. The use of an IRS Federal Tax Identification Number as a company identification is recommended. Otherwise, your Bank will create a unique number for your company. Numeric (10 digits) |

| 2 | Immediate Origin Name | Immediate Origin Name | Company Name, ACME alphanumeric (23 characters) |

| 3 | Immediate Destination | Immediate Destination ID | Originating bank 9 digit routing and transit number |

| 4 | Immediate Destination Name | Immediate Destination Name | Originating bank name, alphanumeric (23 characters) |

| 5 | Company Name | Company Name | Company Name as appears on ACH contract, alphanumeric (16 characters) |

| 6 | Company ID | Company Identification | 1+company tax id numeric (9 digits), Identical to the number in field 1 Immediate Origin ID, unless multiple companies/divisions are provided in one transmission. |

| 7 | Message authentication code | Message Authentication Code | "Optional message", alphanumeric (up to 19 characters) |

| 8 | Originating DFI ID | Originating DFI ID | Originating bank routing and transit number without the Check digit (first 8 digits only) |

| 9 | Reference code | Reference Code | alphanumeric (up to 8 characters) |

| 10 | Service class code | Service Class Code | "200" numeric (3 digits) |

| 11 | Standard entry class code | Standard Entry Class Code | "CCD" alphanumeric (3 characters) |

| 12 | Company entry description | Company Entry Description | "Payroll" alphanumeric (up to 10 characters) A general identification term |

| 13 | Company discretionary data | Company Discretionary Data | "EFT payroll deposit" alphanumeric (up to 20 characters) used to identify this particular transaction |

| 14 | EFT file name and location | File Name | c:/nv/sample.ach |

| 15 | File ID modifier | File ID Modifier | "1" To distinguish multiple files created during the same day. (Upper case A-Z numeric 0-9) |

Testing will be performed directly between your company and your bank before the actual electronic funds transfers can take place. Plan your testing several days in advance before going live with the service.

For information about direct deposit payroll and setting up employees for direct deposit see Direct Deposit Payroll (EFT).