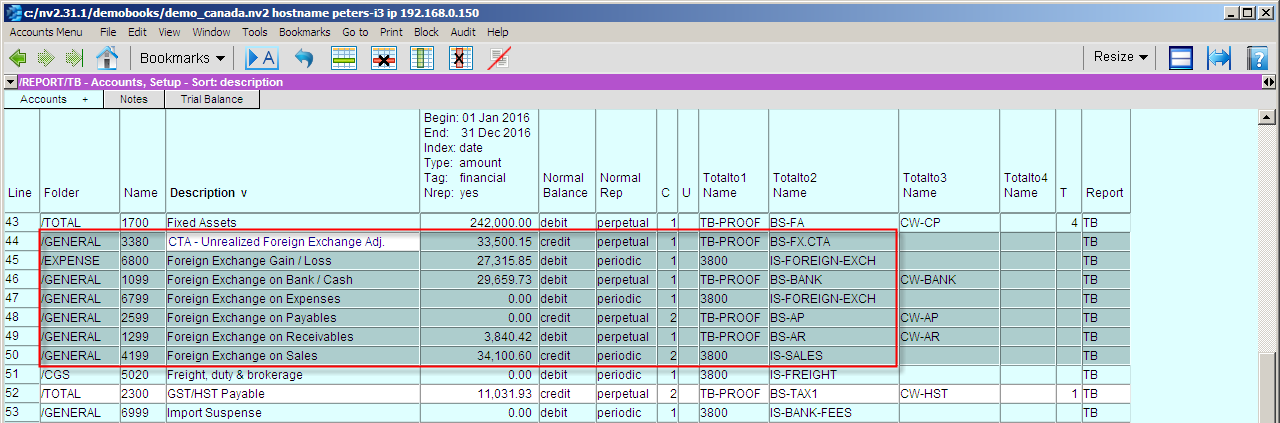

By adding a short list of accounts and periodic journal entries your reports with foreign currency accounts will reflect the correct domestic currency. Note the screen below has the Trial Balance sorted by Description, please see below for more details.

Journal entries adjusts the period end balances of the above Bank, AR and AP accounts, as well as reclassifying Revenue and Expenses.

For example, foreign currency sales are posted to foreign currency sales accounts and foreign currency customer accounts. The total sales and accounts receivable are then synchronized at month end with a journal entry at the existing exchange rate.

All the foreign currency sales accounts should be grouped together and totaled to a new Total foreign currency SALES (FX.SALES) account. All the foreign currency customer accounts should be grouped together and totaled to a new Total foreign currency AR (FX.AR) account.

These total accounts are synchronized periodically and the balances are used to calculate the foreign exchange for the period.

Five general accounts are added to the books, one for each main area that has foreign currency accounts.

Two additional accounts are added to the books used to post the unrealized foreign exchange adjustment

and the foreign exchange gain/loss expense.

Two new reports are added with five total accounts. One for each foreign currency account group.

These accounts are linked

to the five posting accounts above.

If you never purchase goods in a foreign currency you do not need to add the foreign exchange AP and EXPENSE accounts. Alternately, additional grouping may be required depending on the complexity of your books. e.g. Inventory. Cost of Goods Sold, etc

The table below lists all the accounts that need to be added to the Trial Balance, or other appropriate financial reports. Please add the accounts while on the setup view of the account tables.

| Posting accounts required for Foreign Exchange | |||||

| Folder | Account Name | normal balance | normal rep. | Report | Description |

| general | 1099 | debit | perpetual | Balance Sheet | used to post the foreign exchange value bringing the foreign Bank balance in line with the domestic currency. |

| general | 1299 | debit | perpetual | Balance Sheet | used to post the foreign exchange value bringing the total outstanding foreign currency AR balance in line with the domestic currency. |

| general | 2599 | credit | perpetual | Balance Sheet | used to post the foreign exchange value bringing the total outstanding foreign currency AP balance in line with the domestic currency. |

| general | 3380 | credit | perpetual | Balance Sheet | the CTA (cumulative translation adjustment) unrealized foreign exchange adjustment account. |

| general | 4199 | credit | periodic | Income Statement | used to post the foreign exchange value bringing the total foreign currency SALES in line with the domestic currency. |

| general | 6799 | debit | periodic | Income Statement | used to post the foreign exchange value bringing the total foreign currency EXPENSES in line with the domestic currency. |

| expense | 6800 | debit | periodic | Income Statement | the foreign exchange expense/(gain) account. |

| Total accounts for the Foreign Exchange Unrealized Report | ||||

| Folder | Account Name | normal balance | normal rep. | Description |

| total | FX.BANK | debit | perpetual | account displaying the current foreign currency bank balance to be converted. |

| total | FX.AR | debit | perpetual | account displaying the current foreign currency AR balance to be converted. |

| total | FX.AP | credit | perpetual | account displaying the current foreign currency AP balance to be converted. |

| Total accounts for the Foreign Exchange Realized Report | ||||

| Folder | Account Name | normal balance | normal rep. | Description |

| total | FX.SALES | credit | periodic | account displaying the current foreign currency sales to be converted. |

| total | FX.EXPENSE | debit | periodic | account displaying the current foreign currency expenses to be converted. |