Fund Accounting is an accounting system emphasizing accountability rather than profitability, used by non-profit organizations. In this system, a fund is a self-balancing set of accounts, segregated for specific purposes in accordance with regulations or special restrictions and limitations.

Note: please review the non-profit demobooks before starting with the non-profit starter template. The demobooks contain four non-profit sectors demonstrating the flexibility and scalability of the NewViews general ledger. Also review Partitions and Allocations for information on the various methods that NewViews can handle fund accounting. Downloadable from our website.

Non-profits have a need for special reporting to financial statements users that show how money is spent, rather than how much profit was earned. Profit oriented businesses only have one set of self-balancing accounts or general ledger. On the other hand, non-profits can have more than one general ledger depending on their needs. A business manager in charge of such an entity must be able to produce reports that can detail expenditures and revenues for multiple funds, and reports that summarize the financial activities of the entire entity across all funds.

For example, if a school system receives a grant from the government to support a new special education initiative, and receives federal funds to support a school lunch program, and even receives an annuity to award to teachers for research projects — at any given time, the school system must be able to extract the financial activities attributed to these programs and report on them.

Given that funds are essentially having more than one general ledger, the accounts can be designed by the special use of account numbers, each set of numbers therein represent a specific fund. Alternatively, they can be designed by using certain recording and reporting capabilities and features of the accounting software being used. For this reason, many non-profit organizations and the public sector will often use off-the-shelf or custom-designed accounting software that is flexible enough to accommodate the needs of special reporting.

These demobooks contain four sample styles of nonprofit fund accounting account structures.

The Following table shows which aspects of non-profit accounting is demonstrated in which sector.

| Options Featured | |||||||

| Sector | Partition Tags | Allocation Tags | Funds | Restricted | Donations | Receipting | Statistics |

| Education | no | no | yes | no | no | yes | yes |

| Health | yes | no | yes | yes | no | no | yes |

| Housing | no | no | no | no | no | yes | yes |

| Worship | no | yes | yes | no | yes | yes | no |

All features are available everywhere, i.e. donations and receipting can be done with any AR accounts or sub-accounts.

The sample education sector focuses on student accounts and tuition transactions. The AR student accounts are sub foldered into grades.

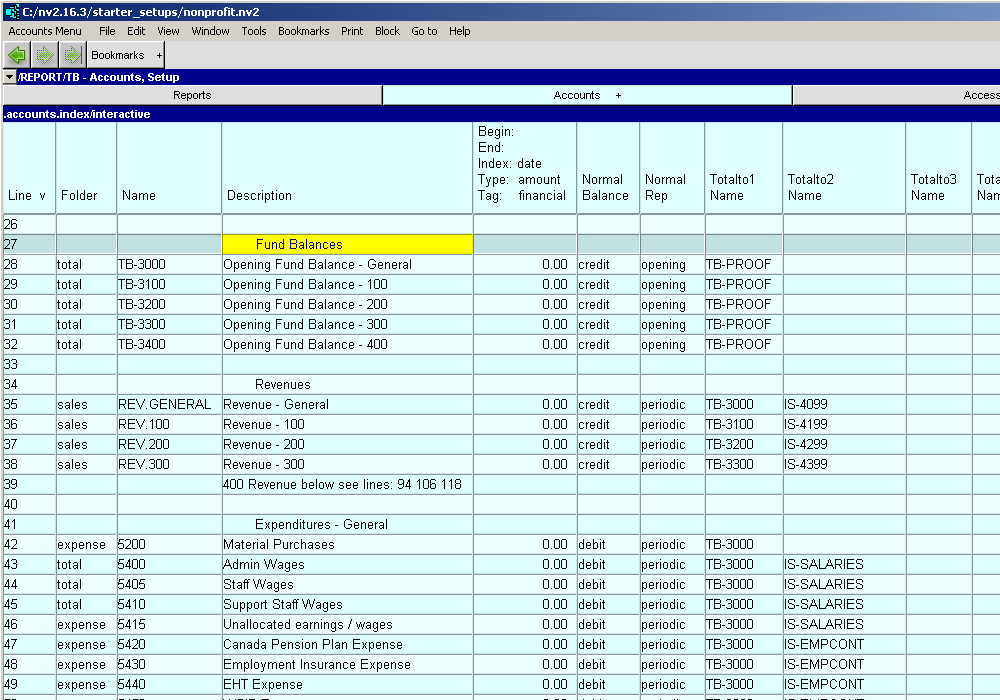

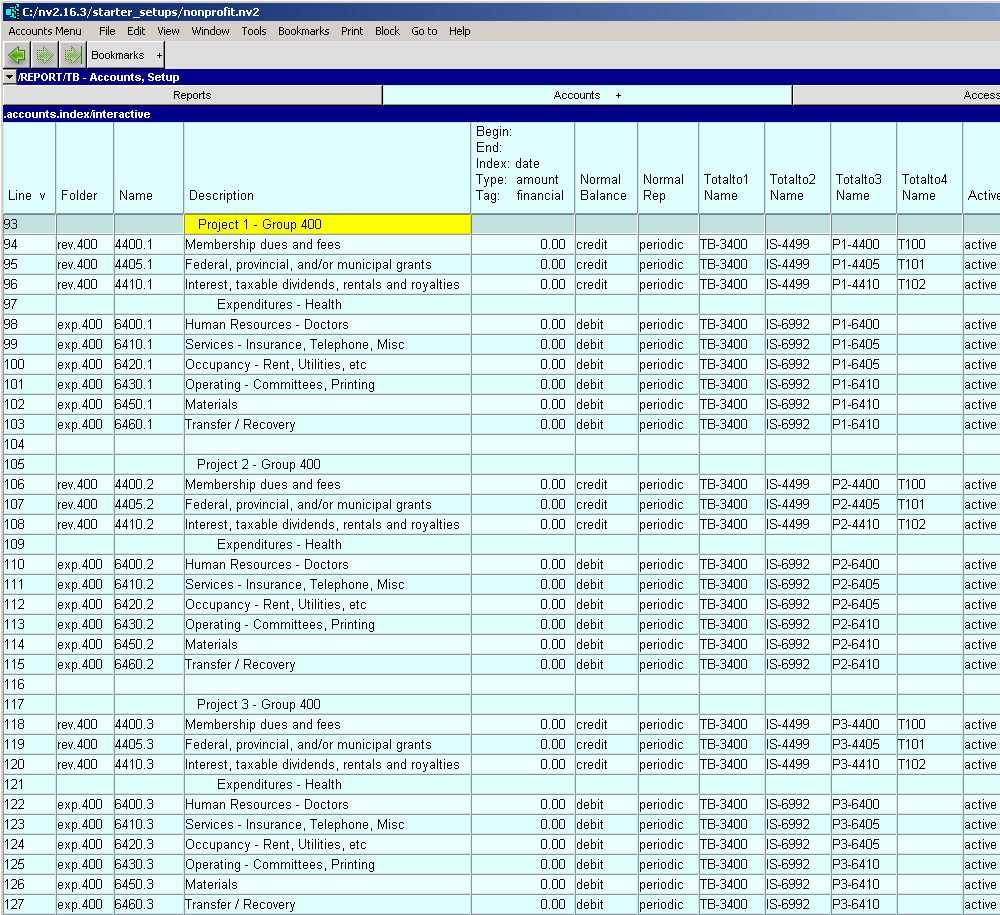

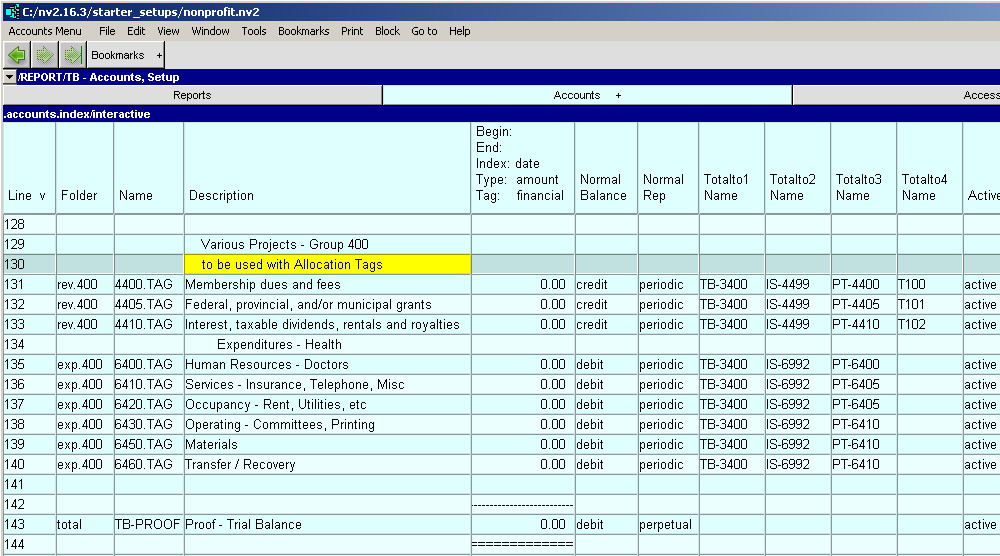

The sample health sector focuses on partition tags and fund accounting. The Health sector as demonstrated is structured for Fund accounting. The GL structure can easily be modified to suite a variety of requirements. The sample Trial Balance has accounts for three funds, this can of course be expanded to an unlimited number of funds.

The sample housing sector focuses on tenants, rent journal transactions and subsidy reports. The Revenue Tenant accounts are sub foldered into properties and individual housing units.

The sample worship sector focuses on fund raising, donations and receipting.

A flexible general ledger is the main requirement with non-profit organizations. For this reason we have provided this starter template.

Some of the highlights of the non-profit general ledger are: