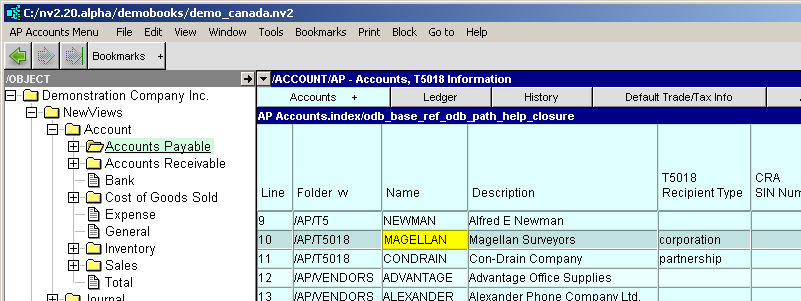

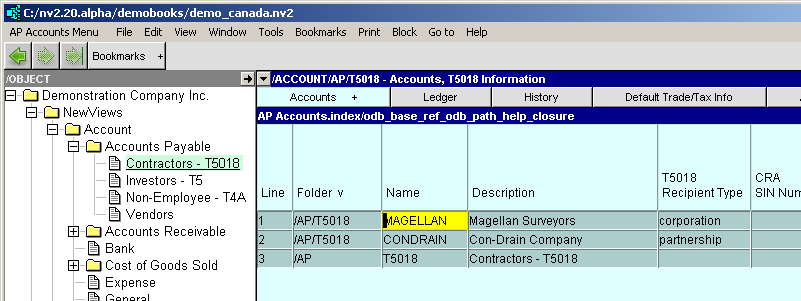

You can print T5018s from any folder of Accounts Payable that you can see accounts/recipients on.

If you activate Accounts Payable you have access to all accounts/recipients and can print any or all T5018s from there.

If you activate a sub-folder you can print T5018s for accounts/recipients of that sub-folder.

On whatever accounts payable folder you decide to print from you must set the T5018 Reporting Year.

Print>T5018s will take the amount to print from the leftmost amount column. The T5018 Information view is initially configured with three columns: financial debits, financial credits, and financial balance. Payments to vendors are debits (reducing the vendor balance) and display negative. Print T5018s will use the absolute value for comparison to the "Minimum Amount", and for printing. The financial credits and financial balance columns are just there for a visual "sanity check", and can be deleted.

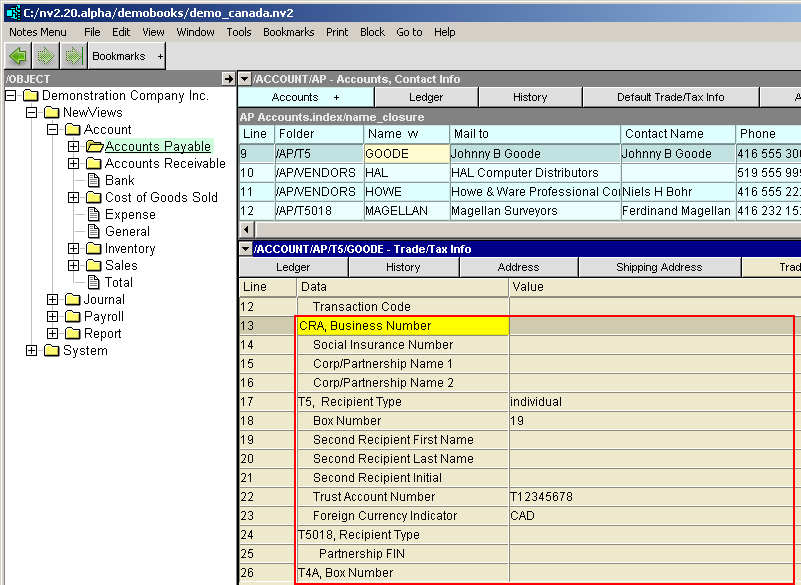

Shown below are rows 13 to 26 of the Trade/Tax Info table of Vendor accounts. Below the screen shot is a table explaining the various groups and rows. Note: CRA rows 13 to 16 pertain to all slips.

| Vendor Trade/Tax and CRA Information Slip Information | ||||

| Line | Form | Field | Description | |

| 13 | CRA | CRA, Business Number | Enter the recipient's 15-character Account Number that consists of three parts; the nine-digit Business Number, a two-letter Program Identifier and a four-digit reference number. | |

| 14 | CRA | Social Insurance Number | Enter the recipient's SIN if required to submit a T4A, T5 or T5018. | |

| 15, 16 | CRA | Corp/Partnership Name 1/2 | Enter the recipient's corporation or partnership name on line 1. Use line 2 if the name is longer than 30 characters or Trading name (if different from Line 1). | |

| 17, 23 | T5 | not applicable for T5018 | ||

| 24 | T5018 | Recipient Type | <F3> to select | individual, corporation, or partnership. |

| 25 | T5018 | Partnership FIN | Enter the partnership filer identification number. e.g. HA0000000 | |

| 26 | T4A | not applicable for T5018 | ||