There are several ways to create transactions.

In NV2, transactions can be added to ledgers via journals, or directly to the account ledgers themselves. When you add a transaction to an account ledger, NV2 automatically records the entry in the specified journal. The end result is identical, regardless of where the transaction is actually added. Any given transaction can also be edited on the account ledger or in the journal. In this way, you have the convenience of posting directly to accounts, and the benefit of having all transactions organized in journals.

NV2 has six (6) journal types, each of which has a specific purpose. The 6 types of journal are Bank Deposit, Bank Payment, General, Payroll, Purchase & Sales. An introduction to journals in general is presented here.

When transactions are used there are two kinds that you run into. A simple transaction only ever has two entries that are opposite signs (+ and -). This is a single movement from one account to another. A complex transaction allows any number of entries, but still has the rule that all the entries must sum to zero.

Simple transactions are the easiest to work with, so if that's the way the business works, it's not worth trying to build complex transactions even though you can support a simple transaction with a complex transaction.

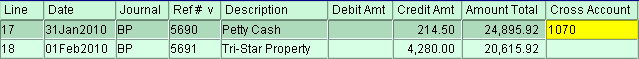

Shown below on Line 17 is a simple transaction that credits the bank $214.50 and debits account 1070 $214.50

With a complex transaction the difficulty often lies in how to create the transaction. A simple transaction can be created in one operation quite easily. However a complex transaction takes a bit more effort.

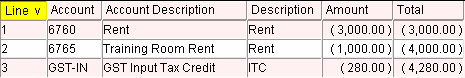

Shown below are the details of Line 18 above. It is a complex transaction that credits the bank $4,280.00 and debits accounts 6760 $3,000.00, account 6765 $1,000.00 and account GST-IN $280.00.

We have separated transactions into:

There is a group of built-in journals; these include Bank, General, Payroll, Purchase and Sales. Each of these journals has a collection of sub-journals for more specific tasks. The Bank journal has sub-journals for Deposits and Payments.

Only the Purchase and Sales Journals have settings for trade tax processing.

The Bank and General Journals have no settings for trade tax processing.

For a beginners how to - step by step guide, use the following links: