To do this:

Click on the window tab marked "Advanced" and select Payroll Settings.

For additional information, see Payroll Settings.

Manitoba, Newfoundland, Ontario and Quebec impose Health, Education and Training taxes on employers.

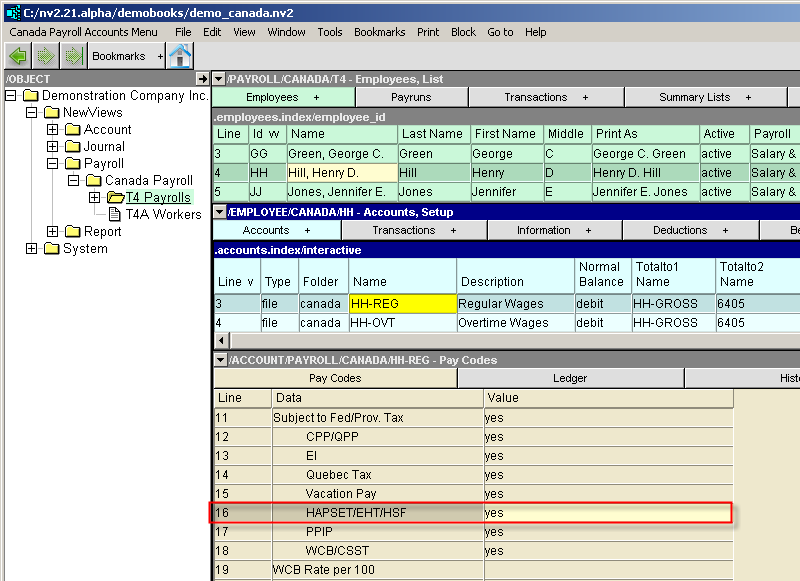

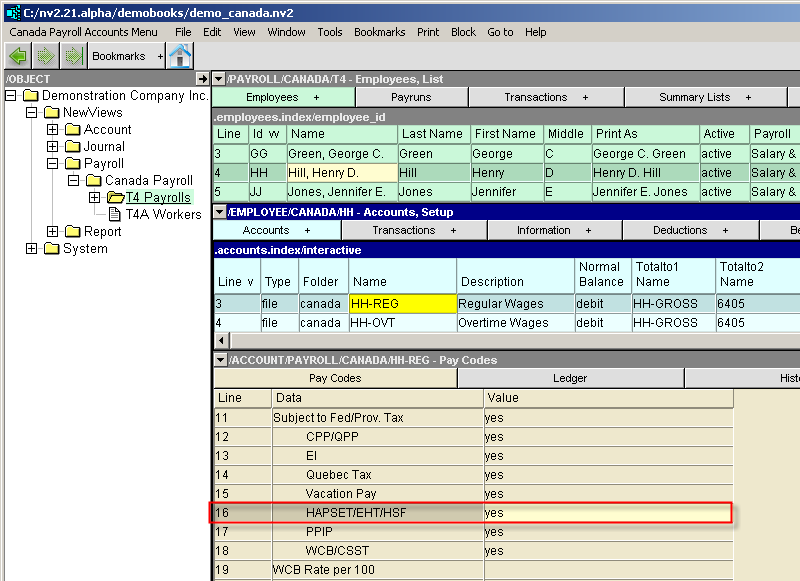

In general the EHT/HAPSET/HSF payroll tax is based on all employment income, including: salaries and wages, bonuses, commissions, vacation pay, directors' fees, payments for casual labour and advances of salaries and wages.

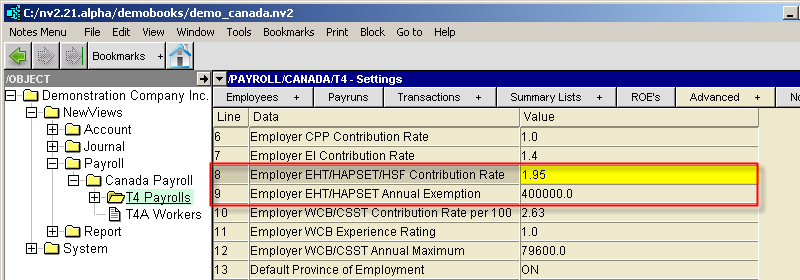

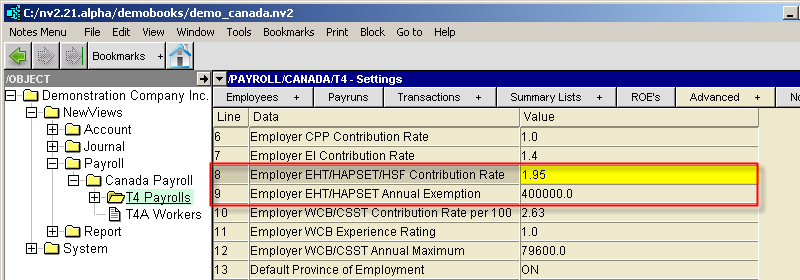

Most jurisdictions (except Quebec) have an annual exemption.

In Ontario, eligible employers do not pay tax on the first $400,000 of annual Ontario payroll.

See Employers Provincial Health / Education / Training taxes

The tax rate varies by jurisdiction and may vary by the total remuneration.

In Ontario, the rate is fixed at 1.95% over $400,000.

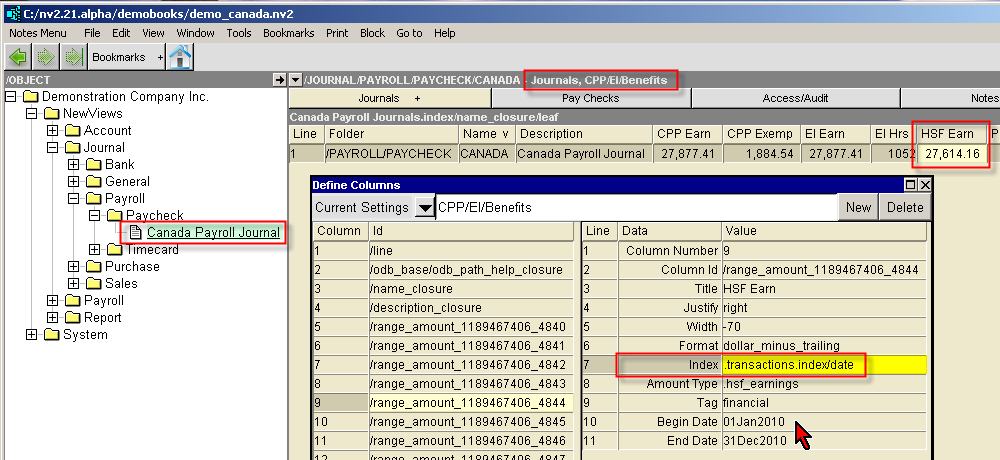

To view the total current EHT/HAPSET/HSF earnings, for the current year, position on the JOURNAL/PAYROLL/PAYCHECK/CANADA.

On the EHT/HSF column, change the index to date, and set the date range to the current year.