Managing Workers' Compensation levies

Workers´ compensation (WC) premiums are levied on employers only by all

provincial/territorial governments to finance the workers´ compensation programs

run by the provincially/territorially administered Workers´ Compensation Boards (WCBs).

-

Alberta - WCB - Workers' Compensation Board

-

British Columbia - WCB - Workers' Compensation Board

-

Manitoba - WCB - Workers' Compensation Board

-

New Brunswick - WCB - WorkSafe

-

Newfoundland - WHSCC - Workplace Health, Safety and Compensation Commission

-

Nova Scotia - WCB - Workers' Compensation Board

-

Ontario - WSIB - Workplace Safety and Insurance Board

-

Prince Edward Island - WCB - Workers' Compensation Board

-

Quebec - CSST - Commission de la santé et de la sécurité du travail (Health and Safety at Work)

-

Saskatchewan - WCB - Workers' Compensation Board

In general the WCB/WSIB/CSST insurance/premium rate is based on all employment income,

including:

salaries and wages, bonuses, commissions, vacation pay, casual labour,

payments to sub-contractors, taxable allowances and advances of salaries and wages.

Excluded are:

directors' fees, retiring allowance, severance pay.

Contribution Rate per 100

The average assessment rates, per $100 payroll, range from 1.22 (Alberta) to 2.75 (Newfoundland).

The insurance/premium rate depends upon what industry category your business is in.

All the WCBs classify businesses according to the industry in which they operate, because it's

assumed that businesses with similar operations share similar risks.

The rates for Workers' Compensation insurance are calculated per $100 of insurable earnings.

Some industries are exempt from mandatory Workers' Compensation insurance.

WCB Experience Rating

The default value is 1.0

All WCBs use a performance-based rate system, which will also affect the cost of your premiums

for better or worse. On the positive side, employers who reduce the number of accidents and injuries

in their operations pay less. The downside is that employers with poor accident and injury track

records pay higher premiums.

The experience rating is a method for adjusting premium rates to reflect an individual employer's claims history.

Employers may receive discounts off their premium for good claims records or may be surcharged for their poor claims records.

Annual Maximum

Most jurisdictions have annual maximum insurable earnings.

See Workers' Compensation - WHSCC, WCB, WSIB & CSST.

Multiple Rates

Some employers with multiple business activities may qualify for multiple rates.

For example, a golf course may split its payroll between outside workers (greens' keepers)

and inside workers (club house/kitchen staff).

Each employee's earning accounts pay code table has a rate field that will override the default

rate set in /PAYROLL/ADVANCED/Settings.

To setup WCB:

-

Position on the appropriate Payroll.

If your organization has one remittance number for payroll deductions and all your payroll is in one province

you may position on the parent Canada Payroll folder.

This will ensure that all employees from all sub-payrolls are included.

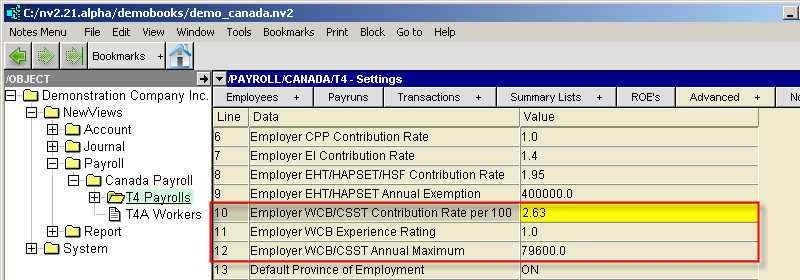

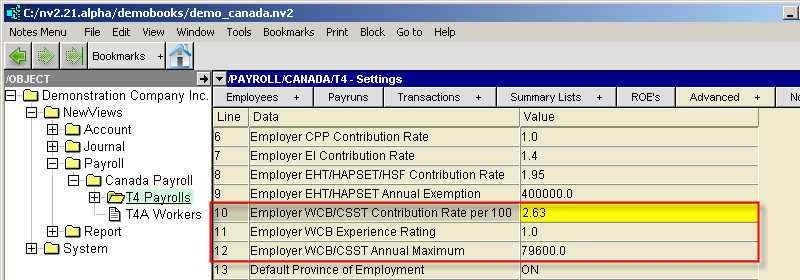

Set the WCB rate and Annual Maximum Insurable Earnings.

To do this:

Click on the window tab marked "Advanced" and select Payroll Settings.

For additional information, see Payroll Settings.

-

Line 10 above specifies the default contribution rate at which the employer WCB/CSST contribution

is calculated.

-

Line 11 above specifies experience rating available in some jurisdictions.

In jurisdictions like Ontario which do not have an experience rating, set this value to 1.0

-

Line 12 above specifies the annual maximum insurable earnings.

See Workers' Compensation - WHSCC, WCB, WSIB & CSST.

If you do not want payroll to calculate the WCB/CSST contribution on each paycheck

(you will do it manually) set this field to "0".

-

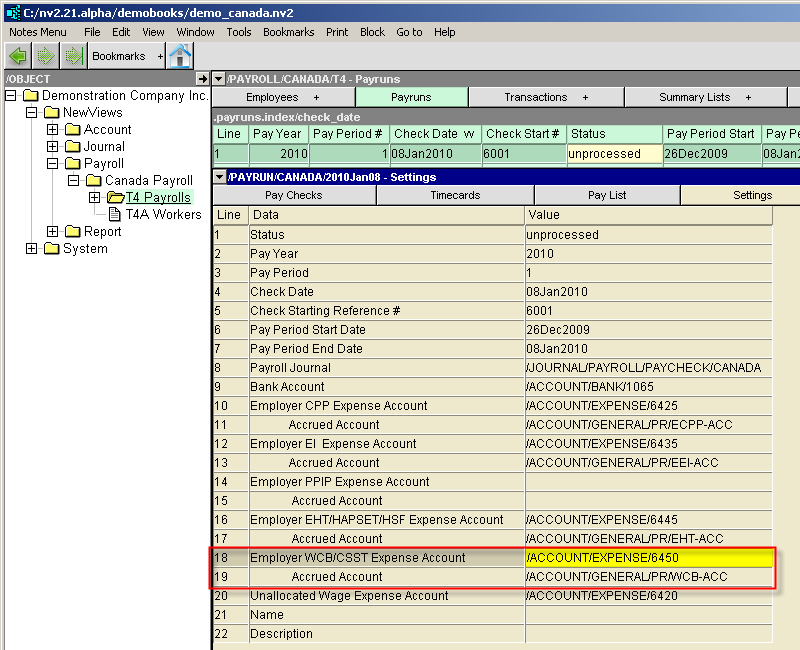

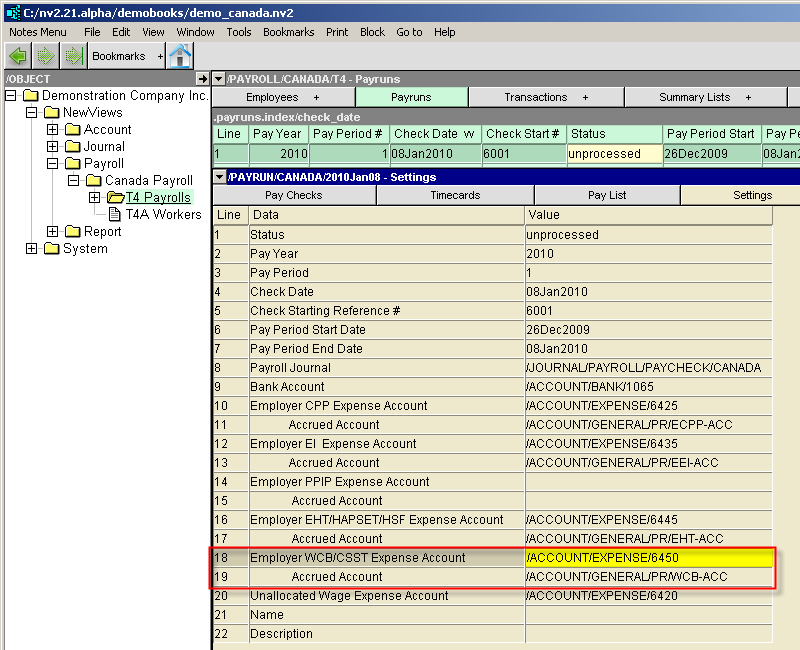

Two accounts need to be specified on the payrun settings.

An expense and an accrued account to be used for posting the WCB/CSST levy.

The accrued accounts should be setup on a Withholdings report, see

adding accounts for WCB.

-

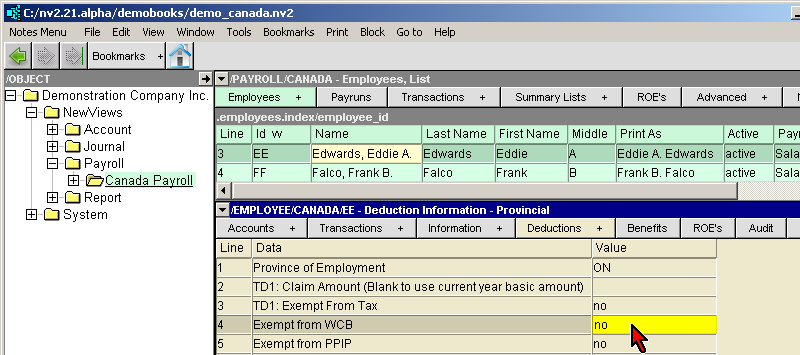

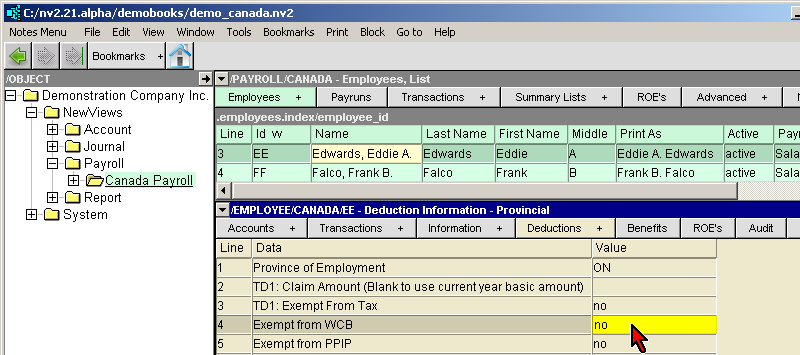

By default only the owners/share holders are exempt from WCB/WSIB/CSST.

-

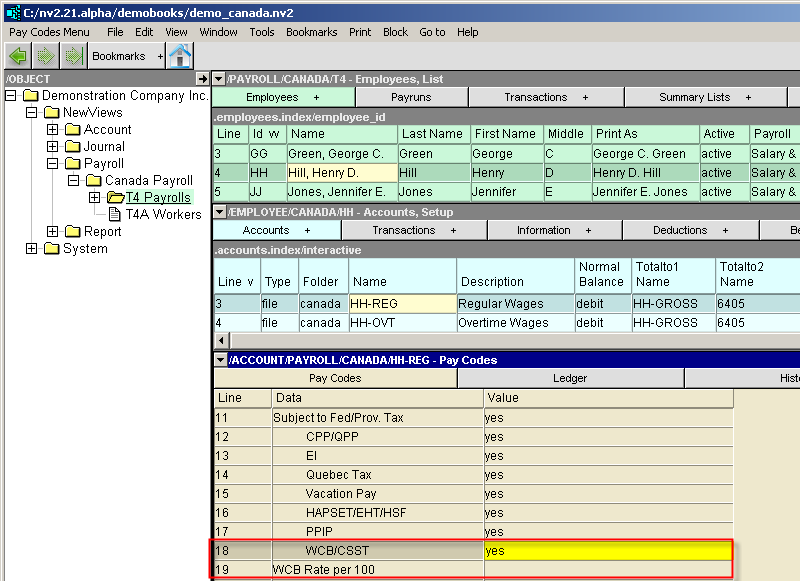

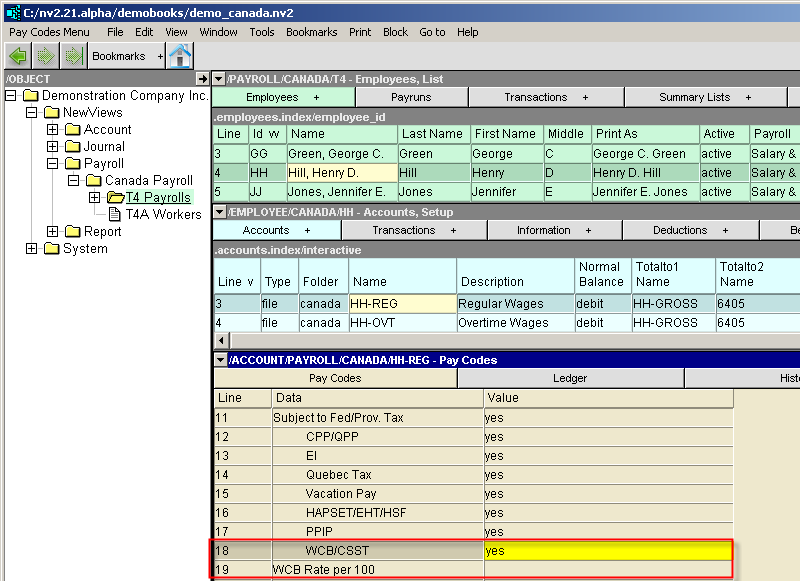

Individual earning accounts can be exempted from WCB/CSST.

Individual rates, different from the default rate can be set for WCB/CSST.

Line 18 (subject to WCB/CSST) can be used to exempt earnings.

Line 19 (WCB/CSST Rate per 100) can be used to override the default rate.

Copyright (c) 2003-2026 Q.W.Page Associates Inc., All Rights Reserved.