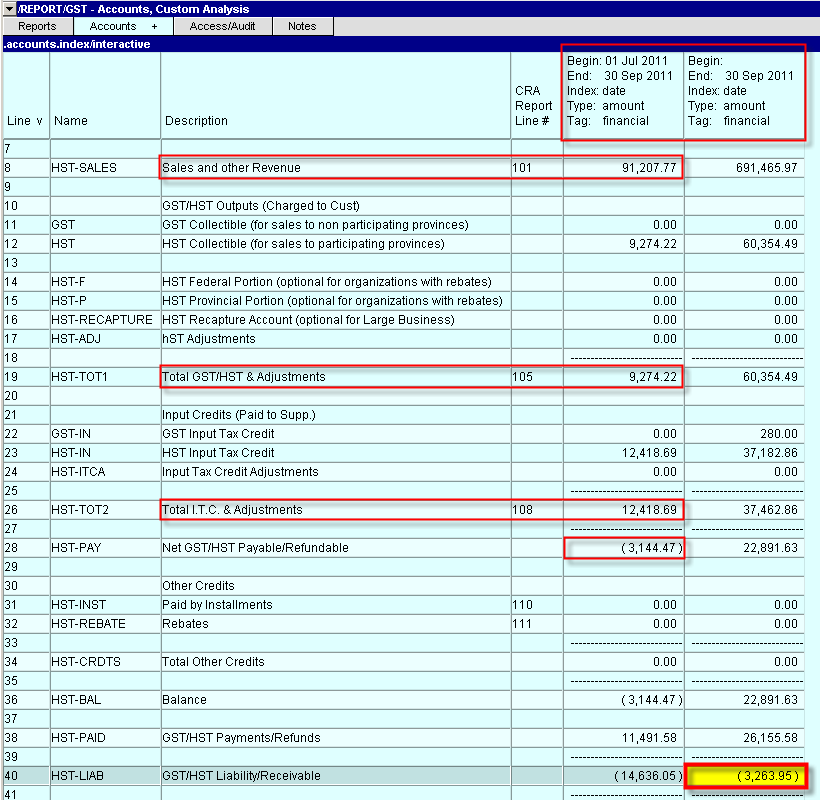

In the Multiple Account Method, the calculation of GST/HST payable/refundable is handled through a GST/HST report. A sample GST/HST report is illustrated below.

The Purchase and Sales Journals allow you to specify default GST/HST accounts and settings. When the account is set, any amount calculated or entered in the TAX column is directly posted on the HST ledger.

As NewViews operates on a real-time basis, the accounts accumulating the GST/HST paid to suppliers and GST/HST charged to customers are automatically updated with every purchase or sales invoice that is entered. The totals for these accounts (for any period) can be seen on the GST/HST report at any time. Also as a result of real-time integration, the GST/HST liability/receivable on the balance sheet will reflect the result of these transactions as well.

The example report shown above is from an organization that was active in a jurisdiction with GST that later changed to HST. For audit purposes it was decided to keep the existing GST accounts and add new HST accounts. The GST accounts are not required if you are starting a new organization in a jurisdiction with HST.

| Description | Account Name | Explanation |

| GST Collectible | GST | This account accumulates all GST charged to customers. A credit normal balance is used since this amount represents a liability to the government. |

| HST Collectible | HST | This account accumulates all HST charged to customers. A credit normal balance is used since this amount represents a liability to the government. |

| HST Federal Portion | HST-F | This account accumulates the Federal portion of HST charged to customers. This is an optional account mostly used by non-profit organizations with rebates. A credit normal balance is used since this amount represents a liability to the government. |

| HST Provincial Portion | HST-P | This account accumulates the Provincial portion of HST charged to customers. This is an optional account mostly used by non-profit organizations with rebates. A credit normal balance is used since this amount represents a liability to the government. |

| HST Recapture | HST-RECAPTURE | This account accumulates all HST charged to customers. This is an optional account for large business. A credit normal balance is used since this amount represents a liability to the government. |

| HST Adjustments | HST-ADJ | Any adjustments made to GST/HST collectible that are to be reported on the GST/HST tax return are recorded in this account. |

| Total GST/HST & Adjustments | HST-TOT1 | The total amount of GST/HST collectible, plus or minus any adjustments. |

| GST Input Tax Credit | GST-IN | This account accumulates GST charged by suppliers that is eligible for refund. A debit normal balance is used to reflect the fact that input tax credits are an asset. |

| HST Input Tax Credit | HST-IN | This account accumulates HST charged by suppliers that is eligible for refund. A debit normal balance is used to reflect the fact that input tax credits are an asset. |

| Input Tax Credit Adjustments | HST-ITCA | GST/HST can require approximation when determining input tax credits. Since these approximations may later prove to be incorrect, an adjustment account is required in which to record adjustments that are to be reported on the GST/HST tax return. |

| Total I.T.C. & Adjustments | HST-TOT2 | The total amount of input tax credits (HST-IN), plus or minus any adjustments. |

| Net Payable/Refundable | HST-PAY | The difference between the TOT1 and TOT2 accounts, representing the total GST/HST owing to, or the refund due from, the government. For most organizations, a credit normal balance is used. If an organization will usually be claiming refunds, a debit normal balance is used. |

| Paid by Installments | HST-INST | If quarterly installments payments are made, this account is used as the cross-account when recording the check in the bank account. |

| Rebates | HST-REBATE | This account is used to record GST/HST rebates. |

| Total Other Credits | HST-CRDTS | The total amount of installment payments and rebates. |

| Balance | HST-BAL | The total GST/HST payable/refundable, minus input tax credits and other credits. |

| GST/HST Payments/Refunds | HST-PAID | When a remittance is made or a refund is received, this account is used as the cross-account, when recording the payment or deposit in the bank account. |

| GST/HST Liability/Receivable | HST-LIAB | The difference between the Balance account and the GST/HST Payments/Refunds account. This account totals to a controlling GST/HST asset of liability account on the general ledger. The general ledger account is included in current liabilities when there is normally a balance owing, or in current assets when there is normally a refund receivable. |

For this example we assume that the organization is reporting on a quarterly basis. The report example shown below is set to Custom Analysis with two amount columns. Amount column one is set for the third quarter, July 1, 2011 to Sept 30, 2011. Amount column two is set as perpetual, ending Sept 30, 2011. In this example the report indicates a refund of (3,263.95).

The true GST/HST Payable/Refundable is the value in the perpetual column. This is the balance of all GST/HST activity up to the report date. This is the value that needs to be reported to the CRA.

Note:

Row 28, Net GST Payable/Refundable indicates a refund of (3,144.47).

Row 40, GST/HST Liability/Receivable indicates a refund of (3,263.95).

This variance is due to back dated invoices for June 2011, entered during August 2011 with a

total of $119.48 HST.

The three main numbers that need to be reported to the CRA should be extracted from column one that is set with the periodic date range. Sales (line 101) is 91,207.77, Total GST/HST (line 105) 9,274.22 and Total ITCs (line 108) 12,418.69. They will not add up to (3,263.95) however, given the variance due to back dated invoices.

Most organizations produce their sales (revenue) invoices on time and within the 30 day limit of the GST/HST report. So Sales of 91,207.77 and Total GST/HST 9,274.22 are correct. The variance of 119.48 needs to be added/subtracted to the Total ITCs of 12,418.69.

The best solution is to take the GST/HST Liability/Receivable amount in the perpetual amount column (3,263.95) (note this is a credit/refund) and subtract the Total GST/HST (line 105) 9,274.22 which equals a Total ITCs value of 12,538.17.