An alternate to the Multiple Account Method is the Single Account method described below.

When a single account is used for GST/HST, all tax postings for sales, ITCs, CRA payments, CRA refunds and adjustments are posted to this one account. The balance of this account is the balance owed to the CRA when the balance is a Credit. If the balance is a debit, the organization is entitled to a refund from the CRA.

Note: The single account method captures all back dated adjustments and transactions.

To get appropriate periodic values for GST/HST report lines 101, 105 and 108, we need to record the total Credit and Debit values of the GST/HST account for the prior report.

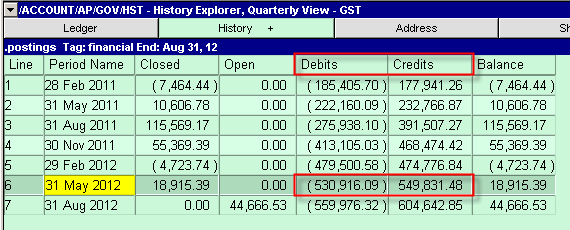

In this example, we assume that the organization is reporting on a quarterly basis. The History view is used to get the quarterly values.

Debits and Credits for the current period must be recorded in the Notes view of the GST/HST account at the time the payment/refund is remitted to the CRA, as shown in the example. Once late expense invoices for that GST/HST reporting period are posted and other adjustments for that period are made to the GST/HST account, the history view will include those transaction. Although the information is accurate for the period it no longer reflects the amounts that were used to report GST/HST when the period ended. This is why it is crucial to capture the "snapshot" of debits and credits at the time GST/HST is reported to the CRA.

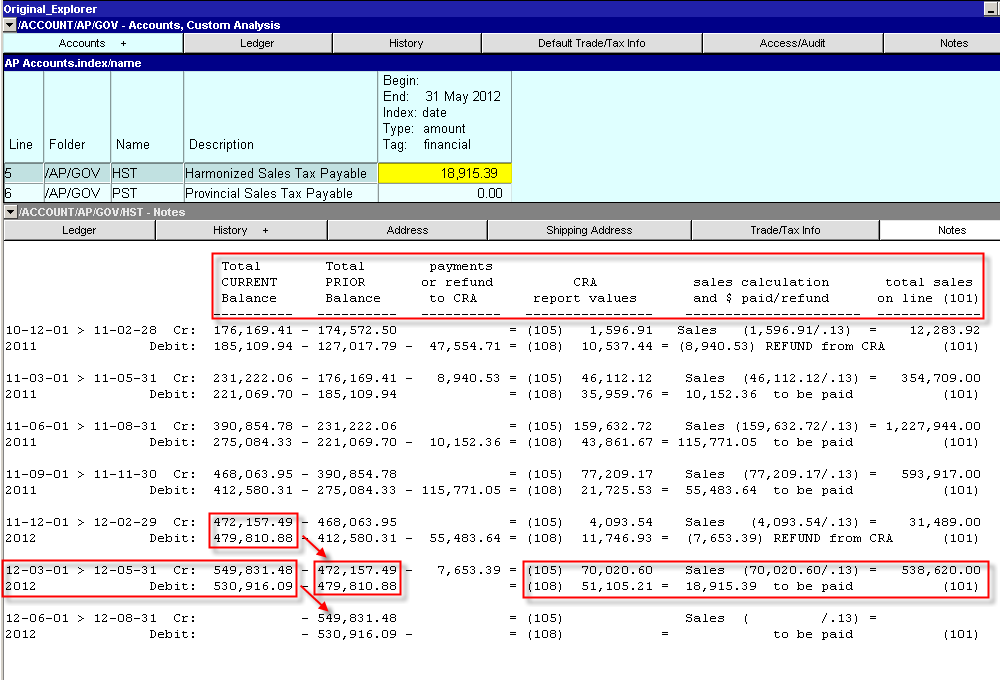

An example of the Notes view of the GST/HST account is shown below.

In the example above, the reporting period is from 12-03-01 to 12-05-31. The total (perpetual) credit balance of the GST/HST account (history view) is 549,831.48. The total (perpetual) debit balance of the GST/HST account (history view) is 530,916.09.

The prior period 11-12-01 to 12-02-29 totals are subtracted from the current totals (see arrows above). These prior period numbers were recorded in the Notes view at the time the last report (Feb 29, 2012) was filed. As Total Credits include the prior period refund of 7,653.39, this amount is also subtracted.

The net Credit periodic value is 70,020.60 (549,831.48 - 472,157.49 - 7,653.39), and this goes on line 105 of the CRA report. The net Debit periodic value is 51,105.21 (530,916.09 - 479,810.88), and this goes on line 108 of the CRA report. The difference between these two net values of the GST/HST Payable/Refundable amount.

To obtain a value for line 101, Total Sales and other Revenue for the reporting period, check your income or P&L statement. Another way is to take the net Credit periodic value 70,020.60 and divide by the tax rate (i.e. 0.13 if HST is 13%). So 70,020.60 / 0.13 = Total Sales of 538,620.00. This goes on line 101 of the CRA report.

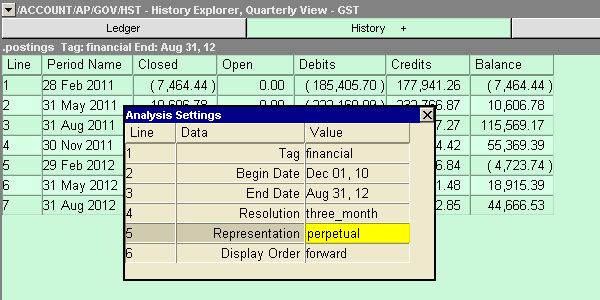

Switch to the History tab and issue the command View>Analysis Settings.

Fill in the prompt as shown below, using the begin and end date for the reporting period.