The Accounts Receivable folder displays all accounts with a variety of information choices.

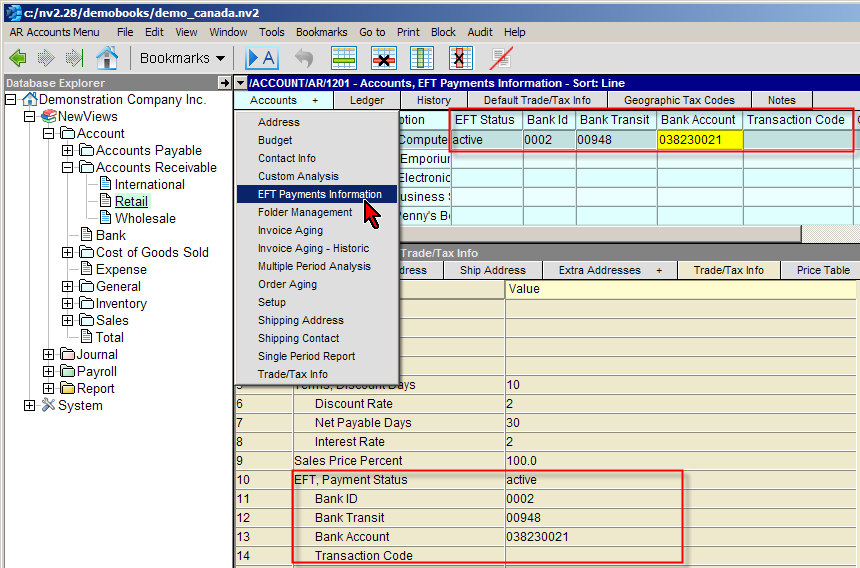

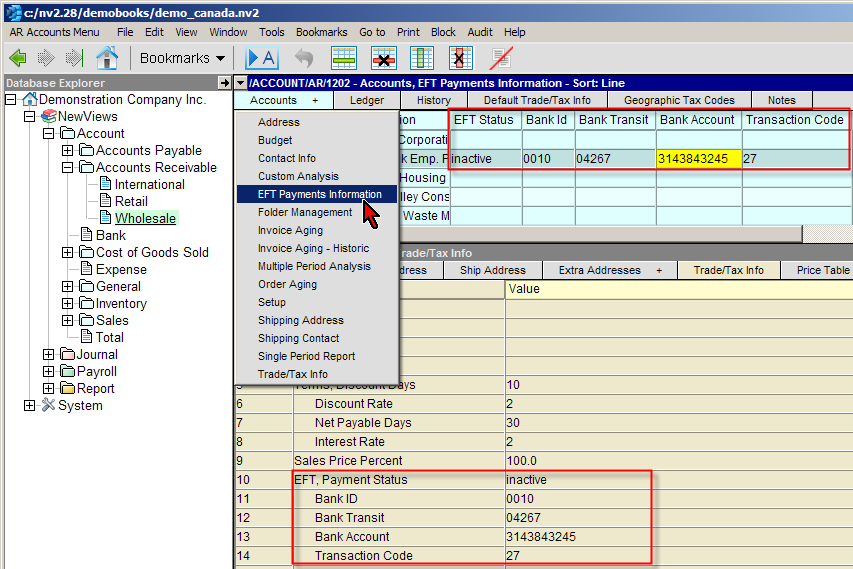

The screen below shows the two places to see and edit AR account EFT information. The top, blue colored table of AR accounts has a view with the columns needed to configure EFT Payments Information, and the five required fields are highlighted. The bottom, sand colored table is the detail pane showing all trade and tax options, and the five required fields are rows 10 to 14.

For more information on changing the views please see Information Views.

Please Note above: that the Bank ID is filled in and the Transaction Code is left blank.

Please Note above: that the Bank ID is blank and the Transaction Code is filled in.

| Receivable Trade/Tax and EFT Payments Information | |||

| Line | Trade Information | Canadian EFT setup | USA EFT setup |

| 1 to 4 | Taxes | Optional settings to Tax 1 and Tax 2 for sales transactions | Used in Canada and other countries to set additional Trade Tax options for sales transactions |

| 5 to 9 | Terms | Set Terms: Discount Days, Discount Rate and Net Payable Days, Interest and Sales Price Percent for a receivable | |

| 10 | EFT Payments Status | When the EFT Payments Status is set to Active, EFT / ACH transactions are created in the EFT file. Also the printing of checks is disabled, and the printing of EFT Payments Advisories is enabled. | |

| 11 | EFT, Bank ID | The 3 or 4 digit number of the vendor's bank | leave blank, see line 10 below |

| 12 | Bank Transit | The 5-digit number of the vendor's bank | Receiving DFI Identification, the 9-digits of Transit Routing Number of the vendor's bank. The first 8-digits of Transit Routing number of bank plus the ninth check digit. |

| 13 | Bank Account | The 7 to 12 digit number of the vendor's bank | The DFI Account Number, up to 17-digit of the vendor's bank account |

| 14 | Transaction Code | leave blank | Press <F3> to see the list of codes |