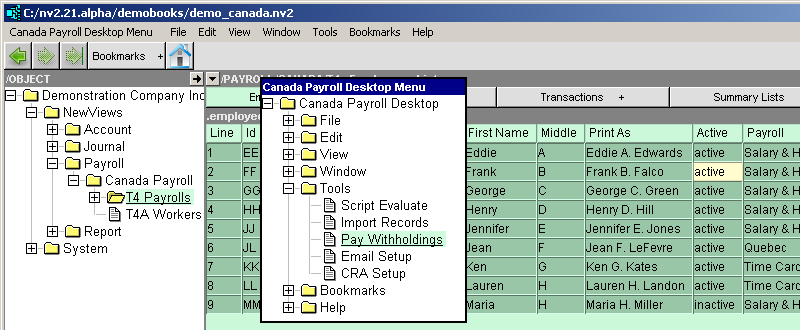

Right-click in the title-bar of the payroll window (the outermost title-bar of the right pane) to display the Payroll Desktop Menu.

Choose Tools>Pay Withholdings from the menu.

Remitting employee deductions and employer contributions requires a check to be created which debits several remittance accounts. The creation of the check entry, and the determination of the correct amounts can be tedious.

This process is made simpler by using the menu command Tools>Pay Withholdings available in the title-bar of a payroll window. This command presents a settings window where information about the remittance is set, and then a preview window is displayed containing the amounts to be remitted. You can review/edit the amounts, then click a button to have the remittance check entry created for you.

The Payroll Withholdings report is used by the Tools>Pay Withholdings command.

See The PW Report for Tax, EI & CPP below for more.

See The PW2 Report for EHT & WCB below for more.

To pay withholdings:

Right-click in the title-bar of the payroll window (the outermost title-bar of the right pane) to display the Payroll Desktop Menu.

Choose Tools>Pay Withholdings from the menu.

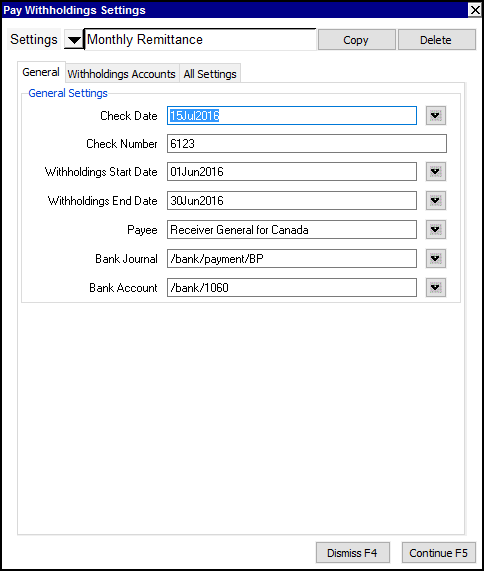

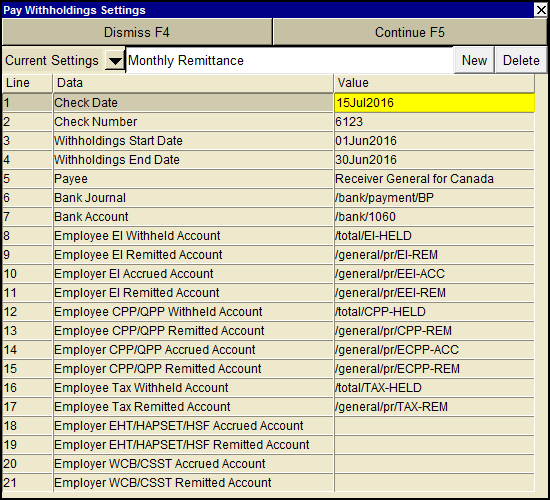

A settings window will be displayed in which you set the date range of withholdings to be paid, bank account name, etc.

The settings you would have to change most often are at the top:

| Pay Withholdings Settings | ||

| Line | Field | Value |

| 1 | Check Date | Enter the date to be used for the remittance transaction. |

| 2 | Check Number | Enter the check/reference number to be used for the remittance transaction. |

| 3 | Withholding Start Date | Enter the start date of withholdings to be paid. |

| 4 | Withholding End Date | Enter the end date of withholdings to be paid. |

The remaining settings, once set, will likely not need to be changed.

| Pay Withholdings Settings | ||

| Line | Field | Value |

| 5 | Payee | This is the name that will be used in the description of the remittance transaction. |

| 6 | Bank Journal | The journal the remittance will be entered in. |

| 7 | Bank Account | The bank account that the remittance check will be posted to. |

| 8, 9 | Employee EI Withheld/Remitted Accounts | The Withheld account is the credit normal balance account that the employee EI deduction account totals to. The Remitted account is the debit normal balance account used to record the amounts remitted for EI. |

| 10, 11 | Employer EI Accrued/Remitted Accounts | The Accrued account is the credit normal balance employer contribution liability account that employer amounts are posted to. The Remitted account is the debit normal balance account used to record the employer contribution amounts remitted for EI. |

| 12, 13 | Employee CPP/QPP Withheld/Remitted Accounts | The Withheld account is the credit normal balance account that the employee CPP/QPP deduction account totals to. The Remitted account is the debit normal balance account used to record the amounts remitted for CPP/QPP. |

| 14, 15 | Employer CPP/QPP Accrued/Remitted Accounts | The Accrued account is the credit normal balance employer contribution liability account that employer amounts are posted to. The Remitted account is the debit normal balance account used to record the employer contribution amounts remitted for CPP/QPP. |

| 16, 17 | Employee Tax Withheld/Remitted Accounts | The Withheld account is the credit normal balance account that the employee tax deduction account totals to. The Remitted account is the debit normal balance account used to record the amounts remitted for Tax. |

| 18, 19 | Employer EHT/HAPSET/HSF Accrued/Remitted Accounts | The Accrued account is the credit normal balance account that the employer EHT contribution liability account that employer amounts are posted to. The Remitted account is the debit normal balance account used to record the amounts remitted for EHT. |

| 20, 21 | Employer WCB/WSIB/CSST Accrued/Remitted Accounts | The Accrued account is the credit normal balance account that the employer WCB contribution liability account that employer amounts are posted to. The Remitted account is the debit normal balance account used to record the amounts remitted for WCB. |

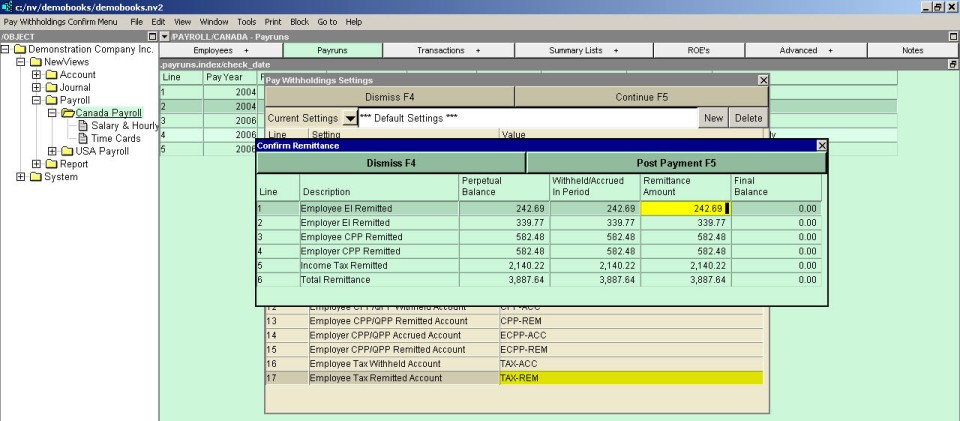

One the settings are complete, press the <Continue>

The Confirm Remittances window allows you to view/edit the amounts that will be paid.

| Confirm Remittance | |

| Table column | Comments |

| Perpetual Balance | This column displays the total (perpetual) outstanding balance for each withholding. This is the total of all withholdings minus the total of all remittances, for all periods. The amounts cannot be edited. |

| Withheld/Accrued in Period | The amounts withheld or accrued in the period specified in the settings window. The amounts cannot be edited. |

| Remittance Amount | The amounts that will be remitted on this check. You are free to edit the amounts if necessary |

| Final Balance | These are the outstanding balances that will result when the check is posted. The Perpetual and Final balance columns are there to make it obvious if you have over or under remitted in a prior period. |

If a Perpetual balance amount is more than the Withheld/Accrued amount, then it means that one or more past remittances were too low.

If a Perpetual balance amount is less than the Withheld/Accrued amount, then it means that one or more past remittances were too high.

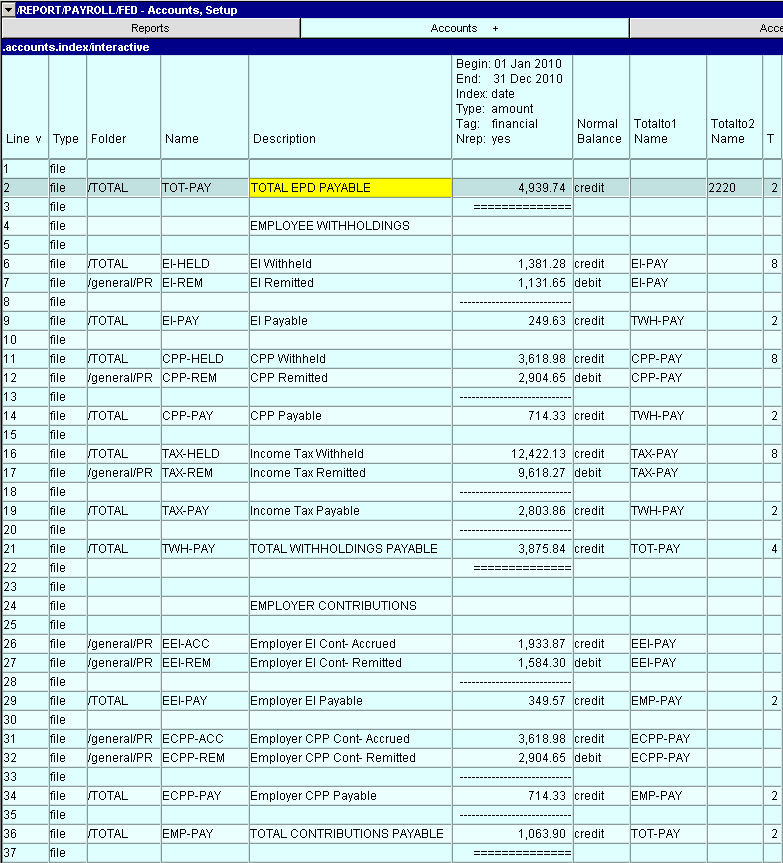

Shown below is a sample Payroll Withholdings Report.

| Account Folder | Description | Acct Name | Normal Balance | Total to |

| Total | Income Tax Withheld | TAX-ACC | Credit | TAX-PAY |

| General | Income Tax Remitted | TAX-REM | Debit | TAX-PAY |

| Total | Income Tax Payable | TAX-PAY | Credit | |

| Account Folder | Description | Acct Name | Normal Balance | Total to |

| Total | Employer EI Contribution Accrued | EEI-ACC | Credit | EEI-PAY |

| General | Employer EI Contribution Remitted | EEI-REM | Debit | EEI-PAY |

| Total | Employer EI Payable | EEI-PAY | Credit | |

Liability accounts (type Total) should be added to the Trial Balance/General Ledger. Then connect the Payable accounts on the PW report to the Trial Balance/General Ledger.

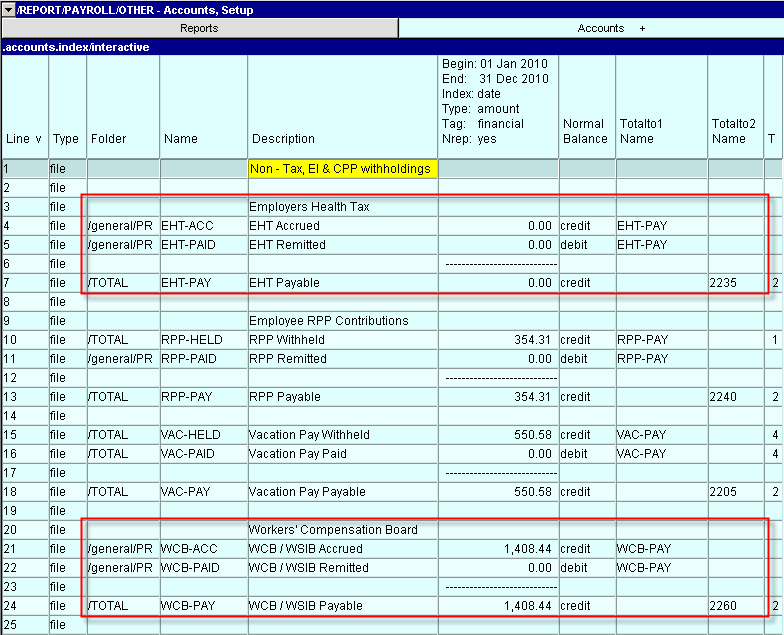

Shown below is a second PW report with four additional payroll liability accounts, EHT, RPP, VAC & WCB. This is the same type of Totalto structure as the standard PW report for Tax, EI & CPP. Highlighted below in red are the accounts needed if you are setting up EHT and WCB calculations per employee.