Direct deposit lets your company forward payroll funds intended for employees electronically and directly into their bank accounts in any financial institution in Canada. Direct deposit is a batch processing, store-and-forward system. NewViews creates a plain text (ASCII) file complying to the format of the Canadian Payments Association. In this documentation such a file is called an EFT file.

In this section we describe how you pay employees using direct deposit. But before you actually use direct deposit, you must set it up. You must set up the company bank account from which you intend to pay the employees, see "Setting up a Bank for EFT", and you must set up each employee for direct deposit, see "Setting up an Employee for Direct Deposit".

Using direct deposit for payroll is much like printing. You generate payroll checks as usual but instead of printing the checks, you send a marked block of checks to an EFT file. You subsequently transmit the EFT file to your company's bank.

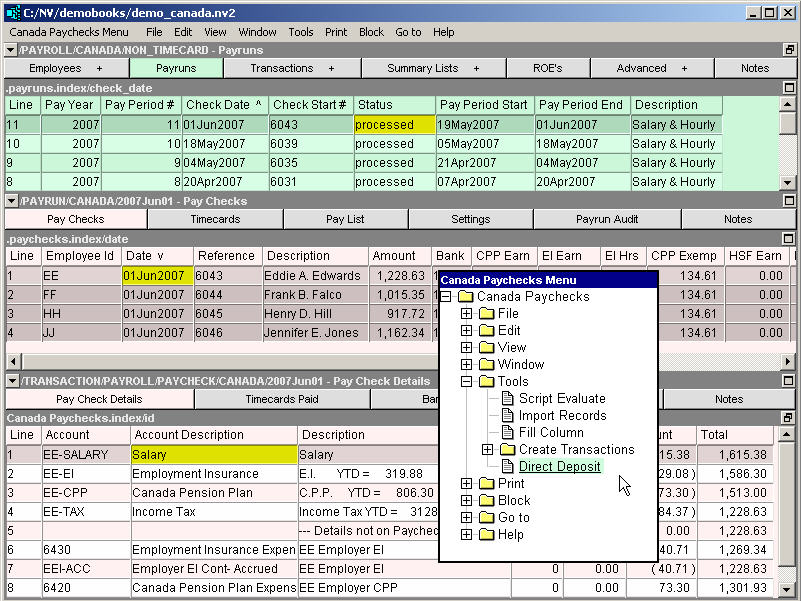

Shown above, a block of employee paychecks has been marked on a payrun's table of paychecks. The Tools>Direct Deposit command is about to be issued.

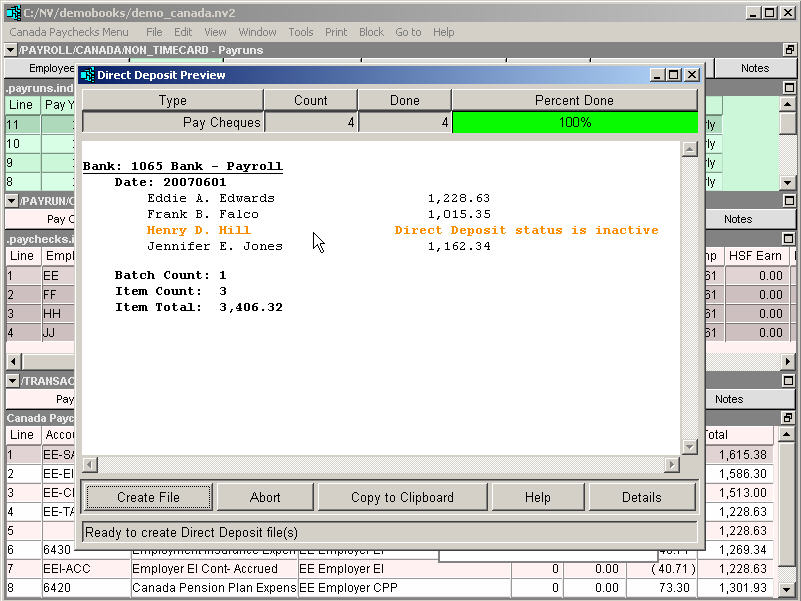

When you issue the Tools>Direct Deposit command, before the direct deposit EFT file is created, you are given a chance to review all information in a preview window as shown above. The preview displays the net amounts that will be deposited for each employee, as well as totals and counts.

Note that employee Henry D. Hill has a paycheck in the table of paychecks but he is not set up for direct deposit. If this was unintentional, click <Abort> to dismiss the preview, set him up, and try again. Otherwise, you can create the EFT file now, but it will skip George.

When you are satisfied with the preview, click <Create File> to create the EFT file.

You must then transmit the EFT file to your bank using the method prescribed by your bank.

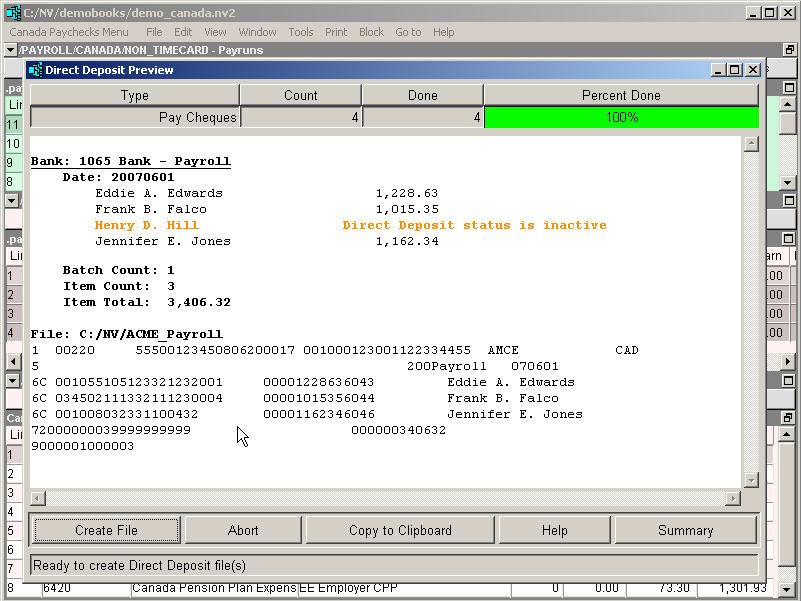

You can display a more detailed preview by clicking the <Details> button. In addition to the summary information, the actual text (ASCII) of the EFT file that will be created is displayed.

When you are satisfied with the preview, click <Create File> to create the EFT file.

You must then transmit the EFT file to your bank using the method prescribed by your bank.

After you produce and transmit your payroll direct deposit EFT file, you will still need to print the EFT paycheck stubs containing the earnings and deduction information (without the actual paycheck) and issue them to you employees. See "Printing Direct Deposit Stubs (EFT)".

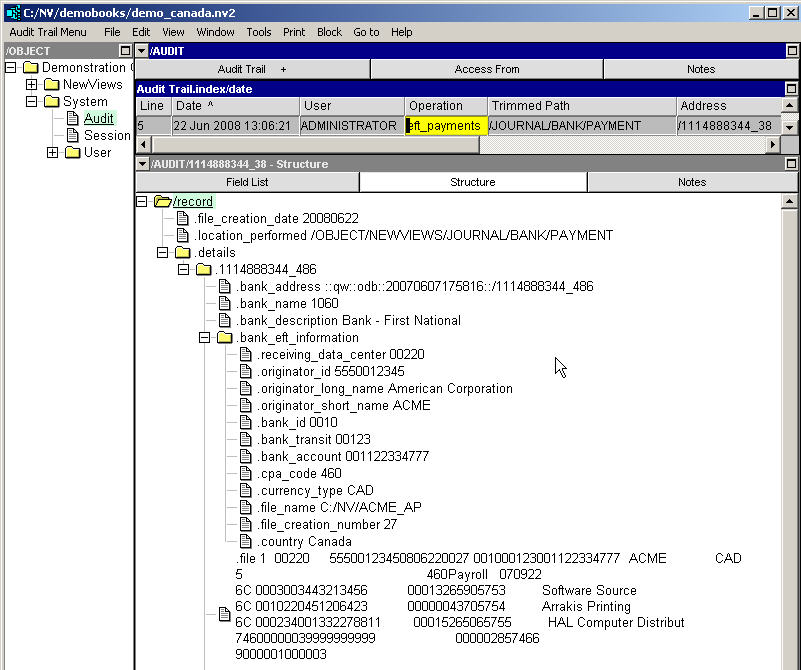

Shown above is the audit record for a payroll EFT transfer. Note in the top pane (grey) that the audit operation is eft_payroll. The bottom pane shows the detailed audit record, identifying the bank, and providing the complete bank information for the EFT transfer. In addition, the audit record displays the actual text that was created for the EFT file. This should help with any discrepancies between your company and the bank, should problems arise.

As usual for any operation, the exact time the operation was performed, and the user, computer, etc., involved, are all displayed. In addition, the Path column in the top pane identifies the location in the set of books that contained the marked block of paychecks used to create the EFT file.

An EFT file can contain transactions payable on different dates as long as the delivery times specified by your company bank are respected. Most banks will not accept transactions dated more than thirty (30) days after the date of creation of your EFT file. Each transaction within the EFT file will actually be transferred by your company bank on the date specified for that individual transaction.

If the EFT file transmitted to your company bank cannot be processed by the bank, the entire payroll, i.e. the EFT file transmitted to your bank, may be rejected. You will be notified by your bank, typically within an hour, that the transfer was rejected. Your company's bank will validate the financial institutions, branch numbers, and bank account numbers for each transaction in your EFT files. Please note that you are responsible for the banking information that you enter in NewViews. Such problems are usually addressed by correcting the information for one or more employees, and then re-trying after generating a new EFT file with the corrected information.