Each NewViews bank account has an EFT Canada Info and a EFT USA Info view. Fill in the EFT Canada Info view if you want to use the bank account for electronic funds transfer. The bank may then be used for EFT payments to vendors and direct deposits to employees, and pre-authorized deposits/debits (PADs) from customers.

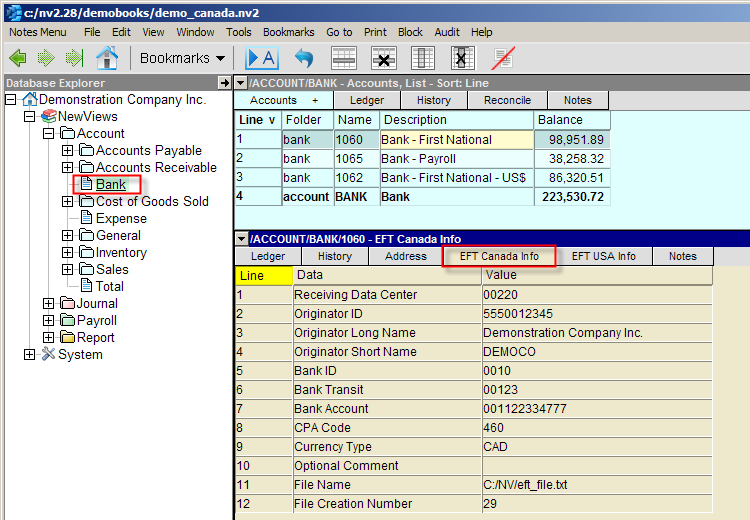

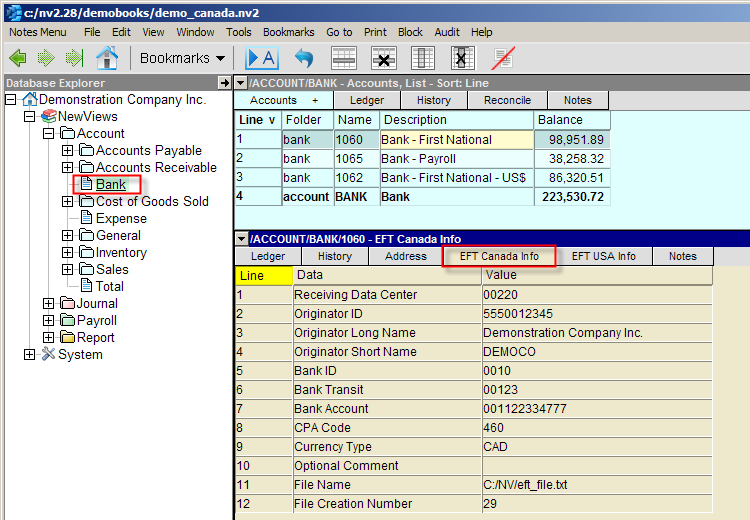

Shown above is the EFT Canada Info view of a bank account, containing the sample settings.

Please take note of the following:

The EFT Canada Info view of a bank account contains settings for both EFT payments to vendors and PADs from customers. Before creating the EFT files that are transmitted to the bank, you MUST change the CPA Code on Line 8 of the EFT settings table.

Consult your bank (or use the links below) to obtain the appropriate CPA Code for EFT payments to vendors and/or direct deposits to employees.

For PADs from customers, use a CPA Code of 319.

Note that the File Name specified on line 11 will be overwritten each time you create an EFT file, and the File Creation Number on line 12 will be incremented automatically.

The bank account EFT Canada Info view contains all of the fields necessary for any of these Canadian banks, but the individual Canadian banks may use only a subset of the fields. Details are provided below on how to fill in EFT information for each of the Canadian banks supported.

The company bank account you use as the source of EFT transfers is restricted to the five Canadian banks currently supported. But this does not restrict in any way the financial institutions used by the recipients of the transfers. We use payroll as an example. For direct deposit of employee paychecks, you must use one of the five supported banks for the company bank account from which you pay your direct deposit employees. But the employee bank accounts in which the funds are deposited can be at almost any financial institution in Canada, not just the five supported banks.

Contact your company bank directly and ask to enroll in their EFT File Delivery services. Your bank will provide a direct deposit form that will collect the information needed by your bank. The initial setup may take several days. Tell your account manager that your accounting software is capable of generating the EFT or Direct Deposit file. With the account manager and the enrollment form, you should have all the information required to set up and activate EFT services with your bank.

The links below provide the required fields for Canadian banks:

Testing will be performed directly between your company and your bank before the actual electronic funds transfers can take place. Plan your testing several days in advance before going live with the service.

For information about direct deposit payroll and setting up employees for direct deposit see Direct Deposit Payroll (EFT).