On the employee table, the window list selector provides the following views:

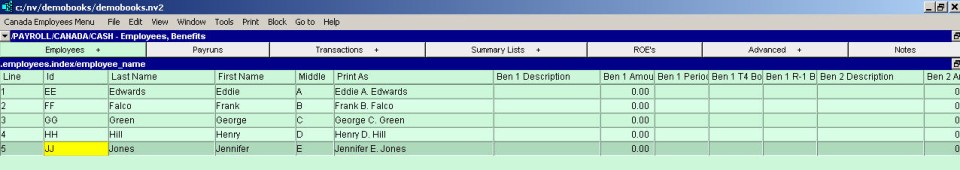

Benefits - Information related to the non-cash taxable benefits the employee receives.

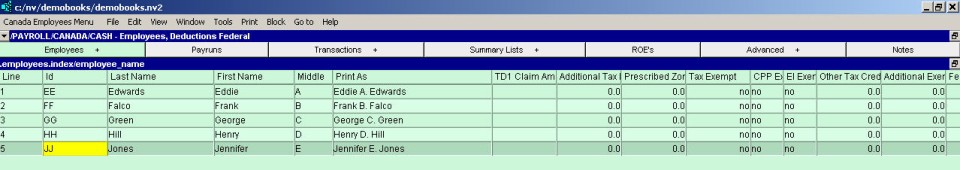

Deductions Federal - Federal TD1 information supplied by the employee that affects federal tax calculations.

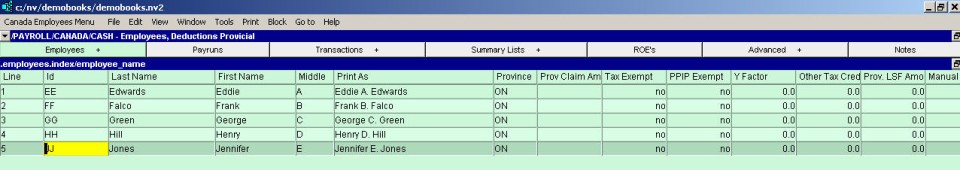

Deductions Provincial - Provincial TD1 information supplied by the employee that affects provincial tax calculations. (All provinces except Quebec.)

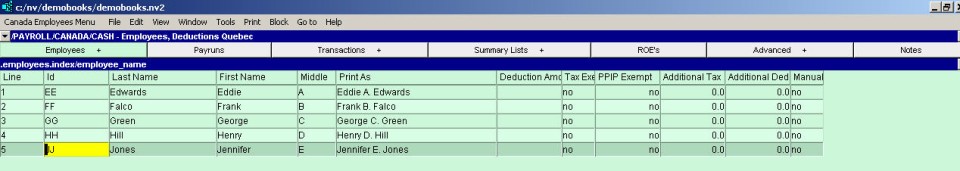

Deductions Quebec - Quebec TP-1015.3-V information supplied by the employee that affects Quebec provincial tax calculations.

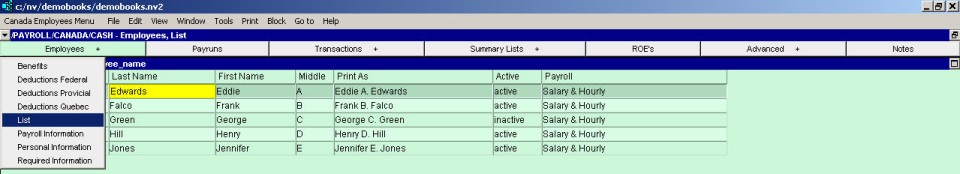

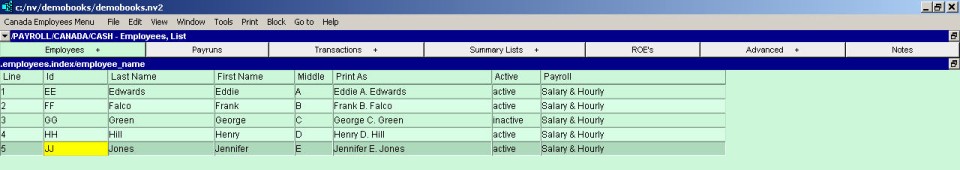

List - A simple list of the employees showing their status (active or inactive) and the payroll they belong to.

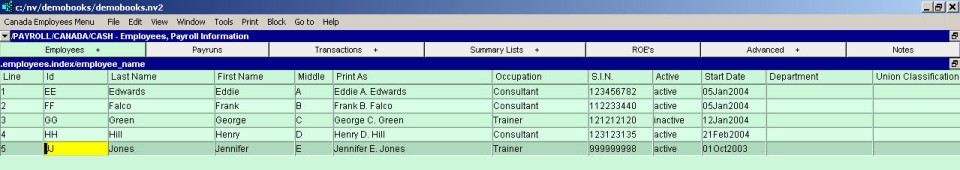

Payroll Information - Payroll administration information such as the employee's hire and termination dates.

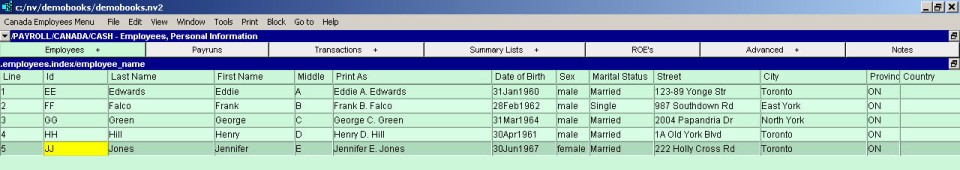

Personal Information - More detailed name, address, & phone number information.

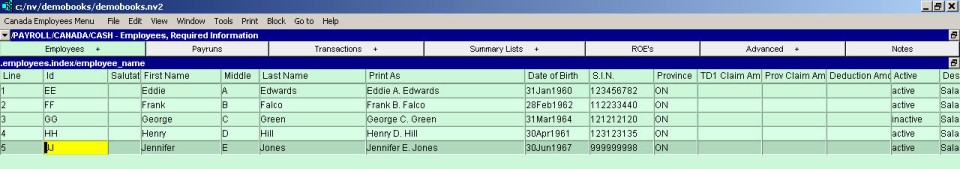

Required Information - The minimum information needed to process and print paychecks for the employee.

The employee list with columns containing the information from the employee's Benefits Information window.

The employee list with columns containing the information from the employee's Federal Deduction Information window.

The employee list with columns containing the information from the employee's Provincial Deduction Information window.

The employee list with columns containing the information from the employee's Quebec Deduction Information window.

A simple list of employees showing Id, name, and the payroll the employee is a member of.

The employee list with columns containing the information from the employee's Payroll Information window.

The employee list with columns containing the personal such as more detailed address and contact information. See also Personal Information window.

The employee list with columns containing the information from the employee's Required Information window.