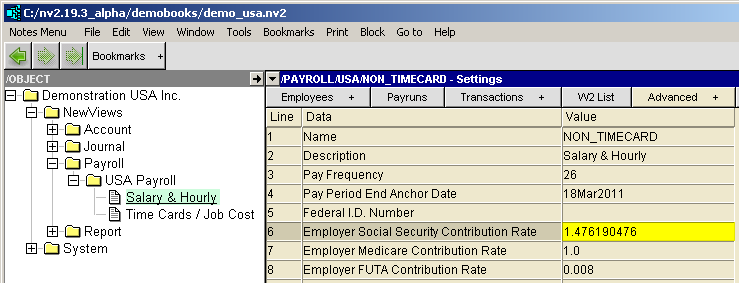

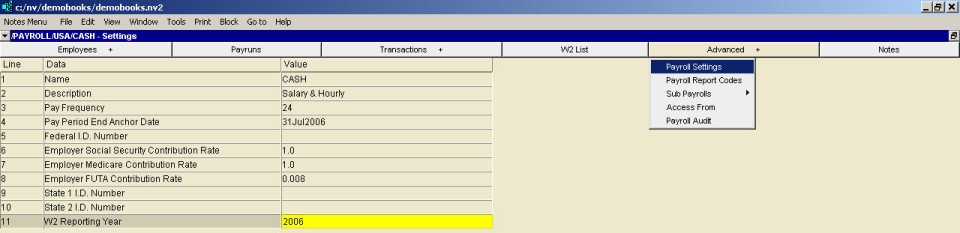

| Payroll Settings - USA | ||

| Line | Field | Value |

| 1 | Name | The name of the payroll folder. |

| 2 | Description | The description of the payroll folder. |

| 3 | Pay Frequency | The number of times an employee is paid in a year. The pay frequency is set to one of: 1 (annual), 4 (quarterly), 12 (monthly), 13 (every 4th week), 24 (semi-monthly), 26/27 (bi-weekly) or 52/53 (weekly). |

| 4 | Pay Period End Anchor Date | The pay period end anchor date for the payroll. |

| 5 | Federal I.D. Number | Enter your federal ID number. It is required for W2 forms and other forms. |

| 6 | Employer Social Security Contribution Rate | This specifies the contribution rate at which the employer Social Security contribution are calculated. This is set to 1.476190476 in most cases. See below If you do not want payroll to calculate the Social Security contribution on each paycheck (you will do it manually) set this field to "0". |

| 7 | Employer Medicare Contribution Rate | This specifies the contribution rate at which the employer Medicare contribution is calculated. This is set to 1 (1 times the employee deduction) in most cases. If you do not want payroll to calculate the Medicare contribution on each paycheck (you will do it manually) set this field to "0". |

| 8 | Employer FUTA Contribution Rate | This specifies the contribution rate at which FUTA contribution is calculated. This is normally set to ".008". If you do not want payroll to calculate the FUTA contribution on each paycheck (you will do it manually) set this field to "0". |

| 9, 10 | State 1 & 2 I.D. Number | Enter your state ID number (where appropriate.) It is required for W2 forms and other forms. |

| 11 | W2 Reporting Year | The year used on the W2 List and W2 List windows. |

In 2011, the employee tax rate for social security is 4.2%. The employer tax rate for social security remains unchanged at 6.2%. The ratio of employer contribution to employee deduction is 1.476190476

How many significant digits are required to get correct contribution amounts ? Below is a table that displays how the number of decimal places affects the resulting contribution amounts. You need to use 9 decimal places to get the correct result.

| Employer Social Security Contribution Rate | |||

| # of decimals | rate | calculated amount | variance |

| 3 | 1.476 | 6,620.7456 | 85.44 cents |

| 4 | 1.4761 | 6,621.1942 | 40.584 cents |

| 5 | 1.47619 | 6,621.5979 | 0.2136 cents |

| 7 | 1.4761904 | 6,621.5997 | 0.0342 cents |

| 8 | 1.47619047 | 6,621.6000 | 0.0028 cents |

| 9 | 1.476190476 | 6,621.6000 | 0.0001 cents |