Making Year-end Adjusting Entries in NewViews

Several months after your fiscal year end, you typically receive a list of adjusting entries from your accountant. This article explains how you should deal with those entries in NewViews.

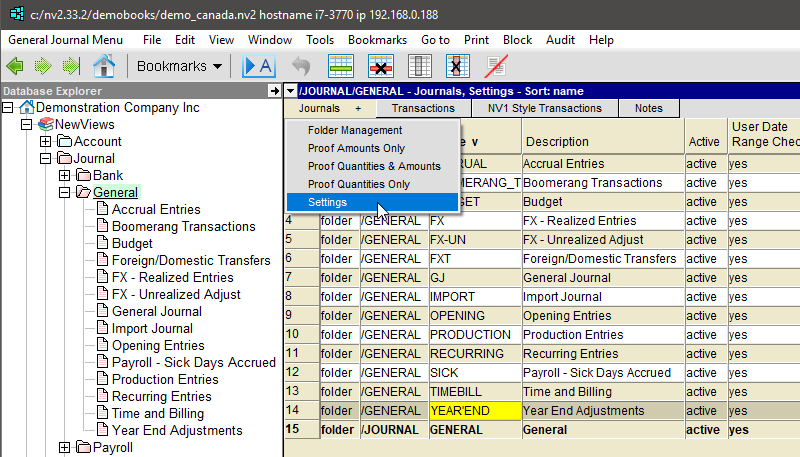

If you don’t already have a general journal specifically for year end entries, you should create one. The Year End Adjustments journal should have the “financial” tag.

Entries fall into several categories, e.g. adjustments to bad debts, depreciation, expenses, payables, payroll, receivables, revenue, etc.

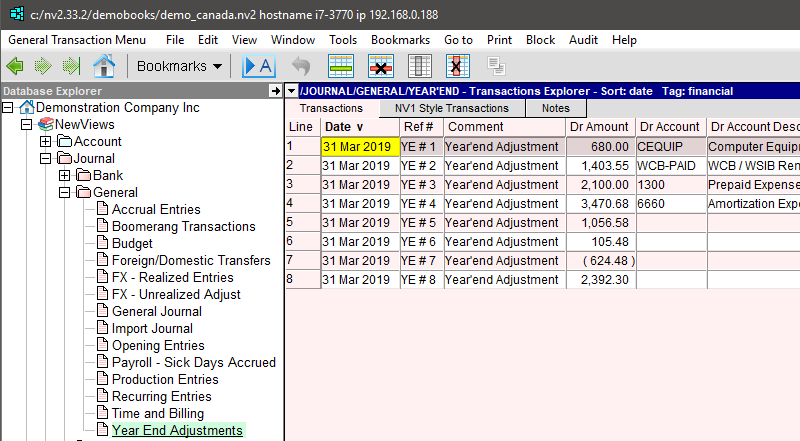

Generally, year end entries are dated the last day of the fiscal year. For example, if your fiscal year is April 1 to March 31, then all entries are dated March 31.

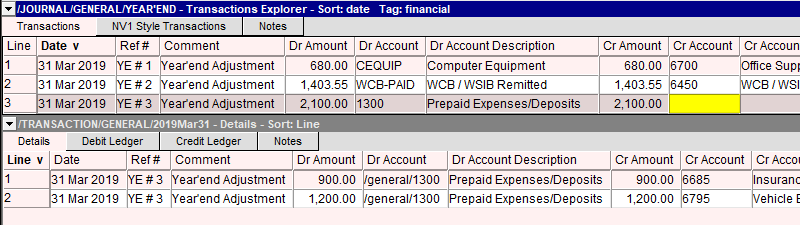

Adjusting entries provided by the accountant usually have a number that should be entered in the reference field as shown above (e.g. YE # 1, YE # 2, YE # 3, etc.).

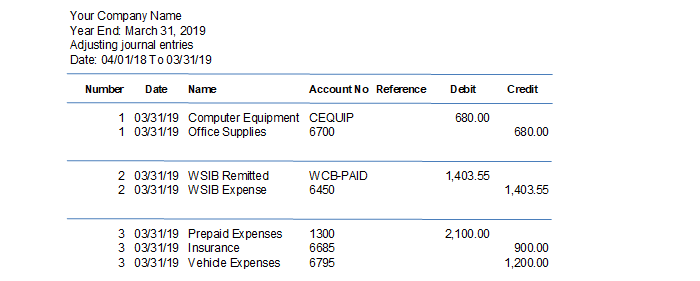

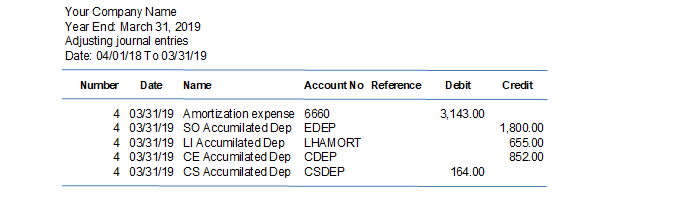

Entries are often provided on several pages, with each entry separated by a line and with a new number. Again, the dates of all the adjusting entries should be the same, followed by the description or the name of the account being adjusted. The amount(s) are entered in the Debit and Credit columns. Here is a standard adjusting journal entries report from an accountant.

Adjusting entries fall into two types:

- Simple – only two accounts are adjusted (number 1 and 2)

- Complex – more than two accounts are adjusted (number 3)

Most adjustments are to posting accounts but some are to total accounts. If you need to adjust a total account, like Accounts Receivable for example, contact your accountant and ask him/her which specific customer(s) are being adjusted. If that’s not possible, create a new AR account named “Accountant’s Adjustments” and post the entry to it. Do the same for AP and/or Payroll.

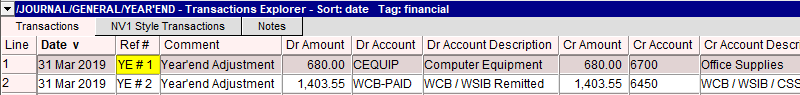

First, we’ll show you examples of simple adjusting entries with only two accounts adjusted (i.e. numbers 1 and 2, as per the accountants report above).

Add a new item and enter the Date; optionally press [F12] to set that date as a default, so each subsequent new item will have the same preset date. Then enter the Ref #, Comment, amount, Dr Account and Cr Account. Repeat for number 2.

Adjusting entry number 3 requires a few more steps since three accounts are being adjusted. Add a new item, then enter the Date, Ref# and Comment. Do NOT enter an amount. One debit and two credits are involved, so we need to use the detail window to allow for more than a two account posting. Since the debit side of the entry has only one value, enter the Dr Account, then press [F6] or double click to open the detail window, where you will add a new item.

In this new item, the Date, Ref # and Dr Account will already be set. Enter a Comment, the Cr Amount and Cr Account (i.e. a $900 adjustment to the Insurance account). Add a second item and enter a Comment, Cr Amount and Cr Account for that item as well (i.e. a $1,200 adjustment to the Vehicle Expenses account).

Notice that for adjusting entry # 3, the Cr Account in the top window is blank. This is because the Cr Accounts for the transaction are set in the companion/detail window below.

To summarize:

- If only two accounts are adjusted, there’s no need to use the detail or companion window below.

- If more than two accounts are adjusted, you will need to use the detail window below. Typically, the first item (top window) is used to set the Dr Account or Cr Account as shown with entry # 3. Remember not to fill in the total amount, as it will be calculated automatically when all the accounts have been posted in the detail window.

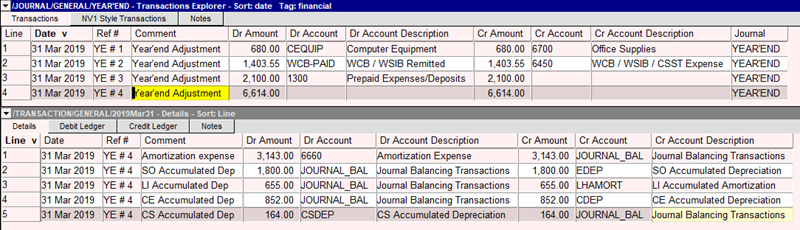

The example below is a more challenging entry. Here we have five parts to an adjusting entry with 2 debits and 3 credits. Although total debits match total credits, itemized debit and credit amounts cannot be paired. In a case like this, we can use an account called JOURNAL_BAL, which is created specifically for this purpose (i.e. to balance adjusting entry items that do not have a logical cross-account).

One way to create this adjusting entry would be to enter the Date and Ref # in the top window , but do not enter any accounts or amounts. Press [F6] or double click to open the detail window, then add five items for the two Dr Accounts and three Cr Accounts. For each of these items, use JOURNAL_BAL as the cross-account. Note: The JOURNAL_BAL account needs to have been added to your General Ledger or Trial Balance in advance to be used in this way.

When you add the items to the detail window, the Date and Ref # will already be set. For the first item, enter the Dr amount $3,143 and the Dr Account 6660, using JOURNAL_BAL as the Cr Account. For the next three items, enter the Cr amounts and Cr Accounts (EDEP – $1,800, LHAMRT – $655, CDEP – $852), using JOURNAL_BAL as the Dr Account. For the final item, enter the Dr amount $164 and the Dr Account CSDEP, once again using JOURNAL_BAL to balance the entry.

Any and all adjusting journal entries can be entered in NewViews using the methods described above. We also recommend that each of the accountant’s entries occupy one header (summary) row in the top window. Add the entries in numerical order for easy reference later; if the accountant’s list of entries skips a number, then leave a blank row with the Ref # set to the missing number.