|

|

|

|

|

|

|

Current Release of NewViews

For optimal performance, make sure you are running the most current version:

NV 2.36.3 (Jan 24, 2023)

For details, click here.

|

|

Has Your Contact Info Changed?

Let us know about any changes to your contact info by sending email to

info@qwpage.com

or calling Customer Service at 1-800-267-7243.

Don't forget to add the following email addresses to your safe sender list:

updates@qwpage.com

office@qwpage.com

|

|

|

|

|

|

|

|

|

Don't want to receive these emails anymore? Unsubscribe.

|

|

|

Winter 2023

|

|

Are Your NewViews Books Structured Properly for Your Needs?

One of the most powerful features that NewViews has to offer is the ability to structure a set of books to reflect your bookkeeping and reporting requirements.

Over the years, however, we have found that some users are not taking advantage of this flexibility due to:

- changes in operations that have not been accommodated in their books

- changes in staff who had varying degrees of experience with NewViews

Now, you have an opportunity to have the structure of your books reviewed by one of our NewViews experts, completely free of charge.

If any opportunities for optimization are found, you will receive a synopsis of what should be done to streamline your books to

ensure you are getting the most out of NewViews. You can then make these adjustments yourself, or contact us for an estimate to have the work done

for you.

To schedule your free review, complete and submit this form.

Please note: At any given time, we have a queue of users waiting for us to optimize the structure of their books to better meet their needs. As such,

the current wait time for your free review can be up to 3 months. That's even more reason to submit a request for us to review the structure of your

books sooner rather than later, as this enables you to reserve a place in the queue.

|

|

Sharing NewViews User Accounts

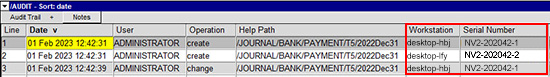

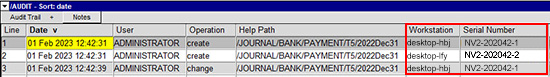

Is sharing NewViews user accounts a good idea? In short, the answer is no. Each user account in NewViews has its own audit trail, so if user accounts are

shared, the audit trail will be shared - at least to a certain extent - as well. Let’s start by discussing a scenario in which users with

NewViews workstations installed on different computers share the same user name.

If users have their own unique workstations and serial numbers but share a user name (e.g. Administrator), you won’t be able to differentiate

the audit trail by the User column, and have to rely on the information in the Workstation or Serial Number

column. This may not seem like a big deal, but when you have multiple users adding or modifying transactions on a daily basis, all of which is recorded in the

audit trail, being able to easily differentiate user activity is important.

Now let’s talk about a scenario in which users share a workstation AND a user name. There is simply no way to know what changes may have been made by which user.

Although this may seem like just a minor inconvenience, it could become a bigger deal if circumstances arise that require a forensic audit of the

activity in a set of books.

As a general rule, it is best to adhere to the following guidelines when it comes to user accounts:

-

Every user should have a unique user name, even if they are sharing a workstation.

-

If there is more than one administrator for a set of books, they should each have their own user name, as any user can be granted administrator rights.

-

Always add a password to the administrator user account, so that no one can log in as with full administrator privileges without knowing the password.

-

You should not rename old user accounts to repurpose them for new users, as this muddies the audit trail.

There is no limit to the number of user accounts in a set of books, and adding new user accounts is easy to do.

For step-by-step instructions, please see the article

Adding New Users to a Set of Books

in the May/June issue of the QW Journal.

|

Auto-fit Columns and performance drag

NewViews has a handy feature called Auto-fit Columns - when it’s turned on, all the columns displayed in the

active pane are automatically resized to fit as much data as possible on the screen. That said, keeping this feature turned on can sometimes

slow down performance slightly. There are also some users who don’t want the data they are looking at to keep shifting as they move

from one active pane to another.

Auto-fit Columns can be turned on and off quickly by clicking the corresponding icon on the toolbar:

Instead of keeping Auto-fit Columns turned on all the time, you can quickly turn it on and off by clicking the

icon on the toolbar twice - once to turn it on and once to turn it off. Many users navigate their books with Auto-fit turned off,

and periodically double-click the icon for an on-demand tidy-up of the columns on their screen.

Did you know that NewViews payroll does WCB calculations?

Workers’ compensation (WCB/WSIB/CSST) premiums are levied on employers by all provincial/territorial governments to finance their

workers’ compensation programs. In general, the WCB/WSIB/CSST premium rate is based on all employment income, including

salaries and wages, bonuses, commissions, vacation pay, casual labour, payments to sub-contractors, taxable allowances and advances

of salaries and wages. Directors’ fees, retiring allowances and severance pay are excluded.

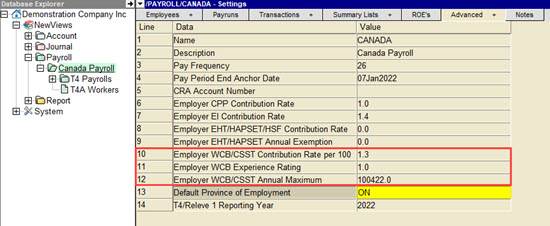

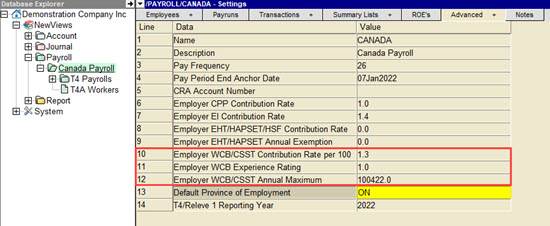

NewViews can automatically calculate WCB/WSIB/CSST once it is set up. If your organization has payroll for only one province and has

one remittance number for payroll deductions, you can set up WCB/WSIB/CSST as follows:

- Navigate to the Payroll folder.

- Click on the Advanced window tab and select Payroll Settings.

- Enter the appropriate values for lines 10, 11 and 12.

- You will also need to specify two accounts in the payrun settings: an expense and an accrued account to be

used for posting the WCB/WSIB/CSST levy. The accrued account should be set up on a withholdings report.

For complete details on setting up WCB/WSIB/CSST, refer to

Managing WCB, WSIB & CSST in the User Guide.

You can also contact our Technical Support team, who would be happy to provide assistance (a valid Support Plan is required).

|

|