Important information on CPP2 for 2024 for Canadian Payroll users

The notice that accompanied the release of version 2.38.0 (December 2023) contained the following information:

“For all Canadian Payroll users, there is a new section in the User Guide under Canada Payroll called CPP2 Primer (new CPP2 rules for 2024 as per the CRA). See the CPP2 Primer for updates required to your account setup before processing payroll in 2024.”

If you have employees that earned more that $68,500 in 2024 then you should have installed CPP2, as per the instructions given. If you didn’t, you need to act quickly to pre-empt a tedious and time consuming CRA Pensionable and Insurable Earnings Review (PIER).

Ideally, you will manually calculate the CPP2 that you should have withheld (it’s not difficult), match it, and add this amount to your last remittance for 2024. This is the key to avoiding a PIER relating to a CPP2 omission.

Then you can install the CPP2 (https://newviews.com/qw_manual_webserver_root/qw_manual/nv2/index.html?n=618020231221122215.htm) and enter simple, one-time general journal transactions to catch up before you prepare T4 Slips and file a T4 Summary.

Generic instructions follow. If you have a current support plan, please call Technical Support at 905-946-9460 and press 1 if you have questions or need assistance.

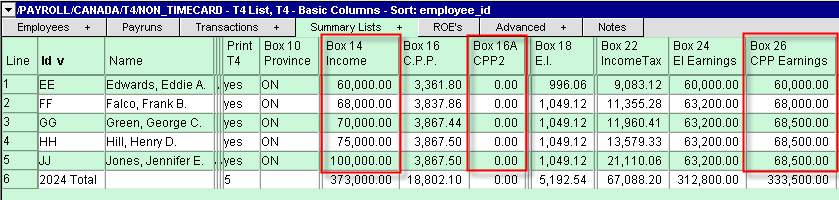

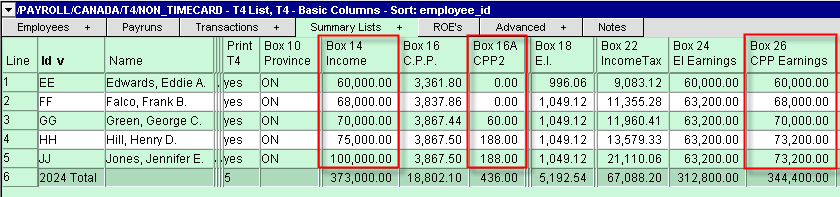

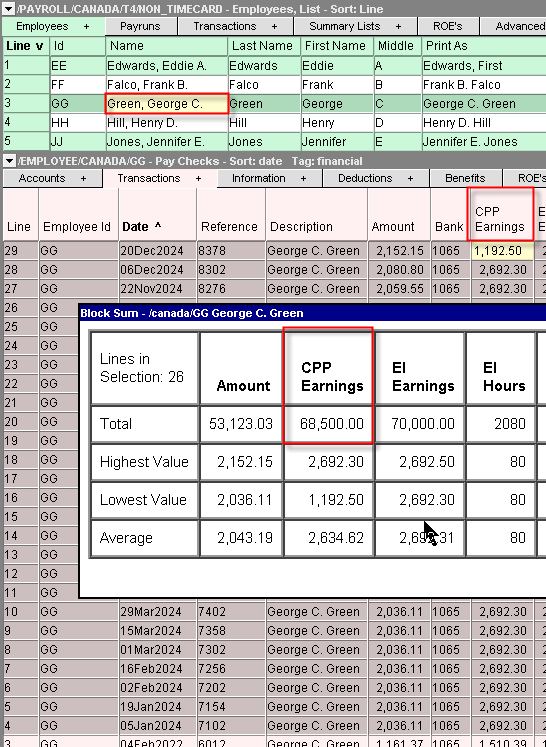

There are two images below that demonstrate the result of omitting CPP2 deductions. This first image displays the problem: Box 16A CPP2 is zero for employees whose Box 14 Income exceeds the CPP maximum of $68,500

and Box 26 CPP Earnings is capped at $68,500 when it should increase with income until it hits the CPP2 maximum earnings of $73,200. The second image displays the correct numbers.

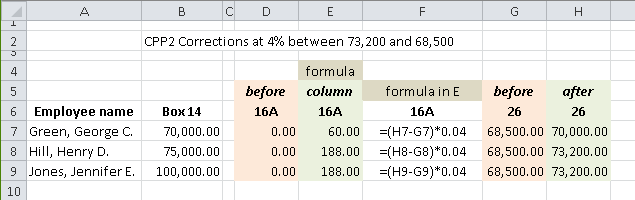

Shown below is a sample spreadsheet demonstrating the arithmetic you will have to perform. Box 26 CPP Earnings used to max out at $68,500 but now it maxes out at 73,200 with a 4% CPP2 premium applied to the difference. For example, George Green’s calculation is $70,000 minus $68,500 equals $1,500 times 4% equals $60. Henry Hill’s calculation is $73,200 (the maximum) minus $68,500 equals $4,700 times 4% equals $188 (the maximum). Jennifer Jones’ calculation is also $188.

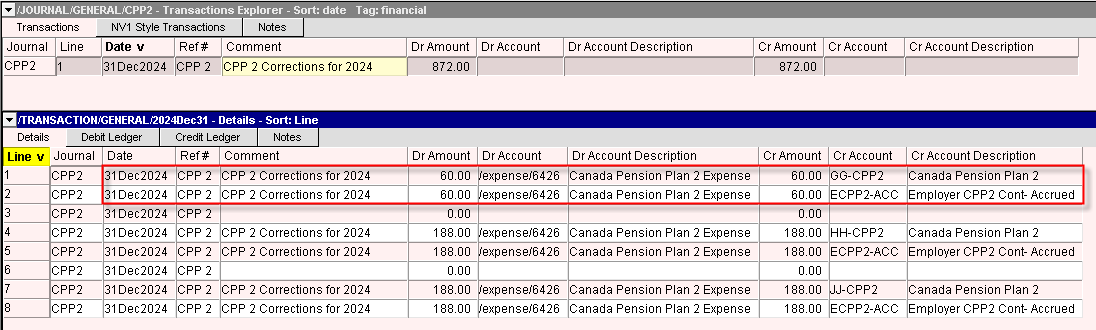

The image below displays a sample General Journal entry, with a pair of distribution items for each employee in need of a correcting entry. Notice the first row of the pair records the CPP2 deduction for the employee’s T4 Slip. The second row records the employer’s matching contribution.

The image below displays the “tricky” portion of the project. You must adjust the transaction header of the last paycheque in 2024 for each employee whose CPP earnings exceeded the $68,500 maximum. For example, George Green’s calculation is $70,000 minus $68,500 equals $1,500. This $1,500 must be added to $1,192.50 for a new CPP Earnings value of $2,692.50, which will bring the total for the year to $70,000.

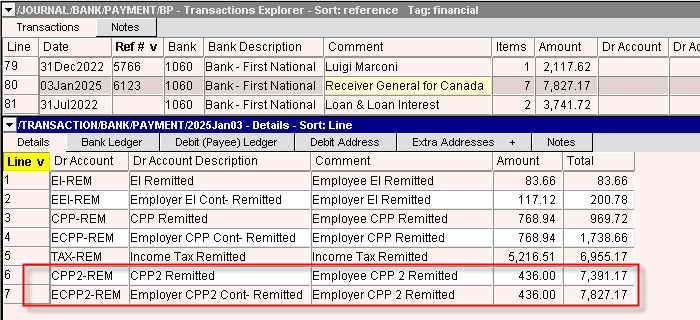

The final image below is a sample of what you must do quickly (i.e. include the missing deductions in your last, on-time remittance payment for 2024).